The tax landscape has shifted significantly over the past couple of years. Allowance reductions, rising dividend tax rates and the proposed extension of IHT to unused pensions means there’s plenty for paraplanners to get to grips with — and plenty of opportunity to add real value for clients.

This Assembly is designed to cut through the complexity and give you a clearer picture of how different tax wrappers work in practice, so you can make more confident decisions about which solution is right for which client.

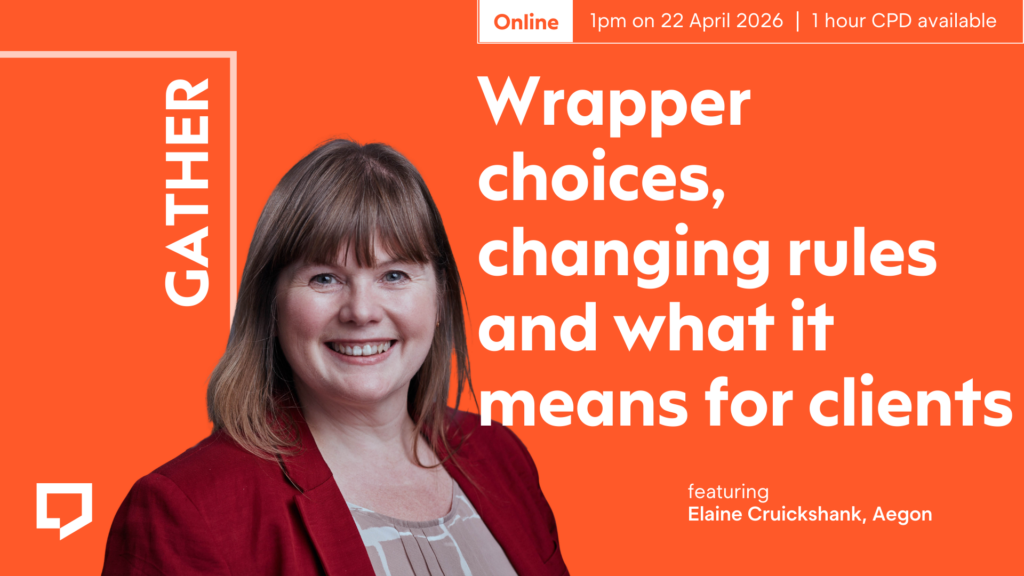

We’ve invited Elaine Cruickshank, tax and trusts manager at Aegon, to join host Richard Allum for a practical, no-nonsense look at onshore bonds, offshore bonds, GIAs and trust solutions — with an agnostic perspective that keeps the focus firmly on what’s best for the client in front of you.

What we’ll be exploring

We’ll look at how recent tax changes are prompting advisers and paraplanners to revisit wrapper choice, and walk through the kind of comparative thinking that helps you work out when a bond might be preferable to a GIA — or when onshore makes more sense than offshore.

We’ll also take a look at how onshore bonds are actually taxed (including a common misconception that’s worth clearing up), which wrapper tends to suit which client circumstances, and how trust solutions fit into the picture — particularly in the context of the proposed IHT changes to pensions.

What can you expect to take away?

You’ll leave with a clearer understanding of the tax treatment of different wrappers, a more confident sense of when each option is likely to work best, and some practical frameworks for thinking about trust planning solutions. We’ll share the comparative calculations in the slides afterwards, so you can refer back to them whenever you need to.

Whether you’re looking to sharpen your technical knowledge or just want to feel more confident having these conversations, join us online at 1.00 pm on Tuesday 22 April.