We held a Powwow in the sunniest city in Scotland on the 18th of April and welcomed paraplanners from those far flung places such as Edinburgh and Inverness, as well as gathering up a gang of locals in Henderson Loggie’s offices. The event was hosted by Colin Stewart and Susan Pringle.

Interestingly, the most notable comment was that we didn’t know there were so many of us!

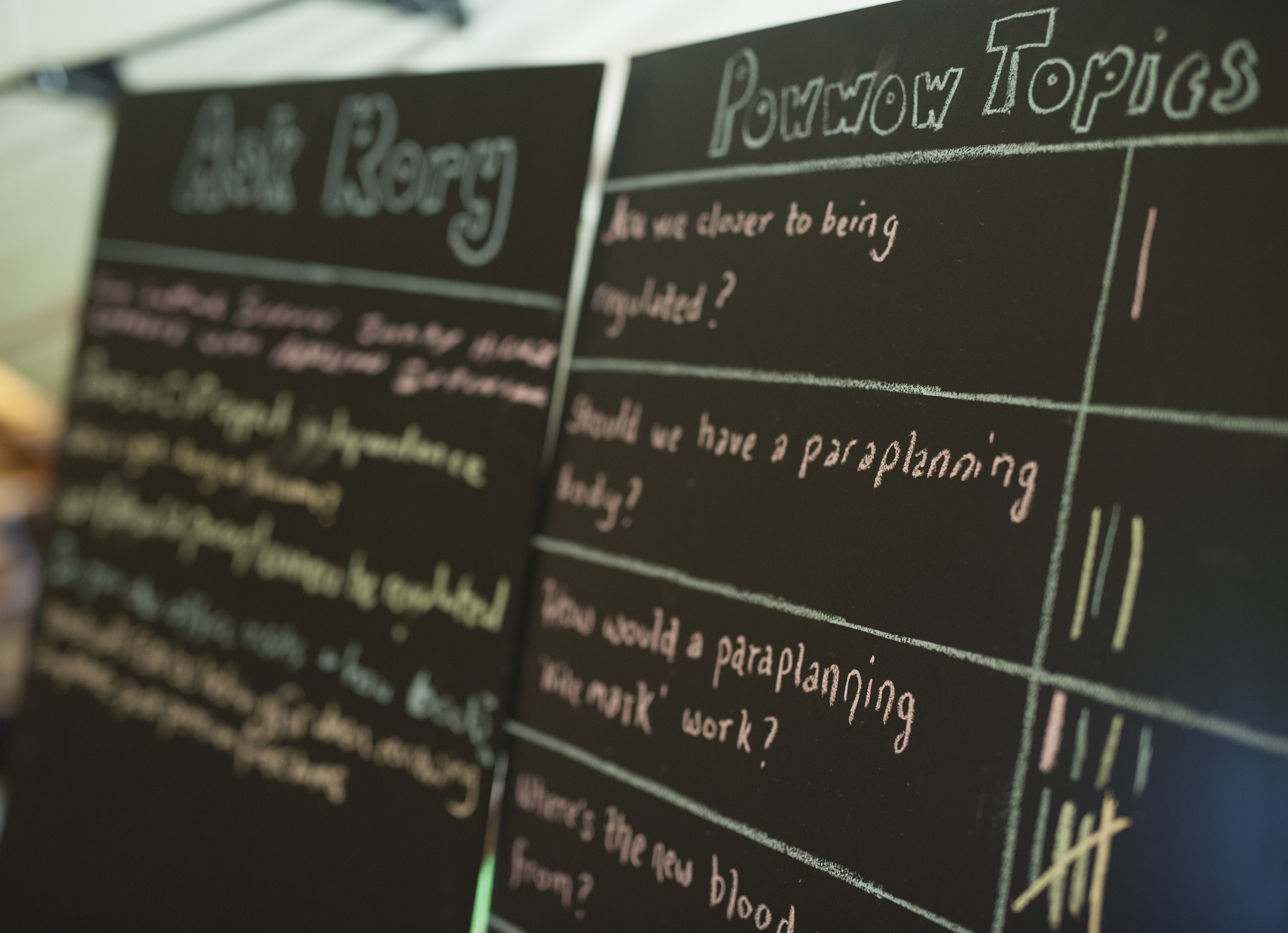

We decided to split the group into two tribes to attempt to cover as many subjects as we could in the time available. Not unsurprisingly, the most requested topics included Report Writing and Risk Profiling/Capacity for Loss.

A number of attendees said they either use report writing software or are considering it. Some offered good feedback of threesixty’s new templates which are more concise and client focussed. Some firms will break their reports down into ‘strategy’ reports, where the broad financial plan is presented and these are supplemented by more focused ‘implementation’ suitability reports.

All firms used risk profiling tools, the most common being Distribution Technology. In the main, this is because many investment managers map the risk of multi-asset funds to DT’s outputs. All agreed that a risk questionnaire and results are just the starting point for a discussion about risk. We discussed the difference between risk tolerance vs capacity for loss and a few firms use cash flow forecasts to assess capacity for loss.

Both groups were interested in the options available across the region to assist with exams and keeping up to date with industry changes. Indeed, post the Powwow, several paraplanners signed up for the PFS Purely Paraplanning Conference in Glasgow on the 4th of May. The use of Twitter and the Professional Paraplanner magazine were highlighted as being good sources of information, especially with CPD being available. Several providers were also pointed out as having paraplanning specific sites, including our supporters. The Powwow Big Tent allows users to post questions to be answered by other paraplanners and came highly recommended.

With regards to exams and techniques, many felt that that the text books were not enough in isolation and each used additional resources such as Wizard Learning, Redmill Advance and Brand Financial Training, with some having engaged with Expert Pensions to provide structured plans for AF exams. Old Mutual have also offered classroom courses. Unfortunately, it’s been very much a case of finding out what’s available through word of mouth.

We also touched on what a good review process involved. We all agreed that reflecting back on the client’s original objectives was paramount, and that having a process in place to ensure these were handled correctly was vital. There was a mix across the group of how involved paraplanners were with regards to attending client meetings. It was agreed that as most are employed in small IFA firms, time constraints mean that it isn’t always feasible to attend a client meeting.

Finally, we discussed the benefits or otherwise of paraplanners holding CF30. A few attendees have CF30, primarily for ‘locum’ reasons – the client would still be able to get advice from the firm in the adviser’s absence. Some argued that CF30 makes you a better paraplanner as you develop empathy with the clients through the advice process.

Edinburgh and Glasgow will be up next.