Here’s a question that might keep you awake at night: what do you tell clients who’ve spent years building pension pots specifically because they were IHT-free, only to discover that’s all changed?

On 21 July 2025, HMRC published their response to the pension IHT consultation, along with draft legislation that will bring unused pension pots into the inheritance tax net from April 2027. The writing’s been on the wall since Rachel Reeves’ October 2024 Budget announcement, but now we have the detail and it’s time to work out what this means for our clients.

As paraplanners, we’re about to face some of the most fundamental shifts in retirement and estate planning strategy we’ve seen in years. The days of treating pensions as the IHT-free golden goose are numbered, and clients will be looking to us for answers.

This isn’t just about understanding the new rules. It’s about completely rethinking how we approach pension planning, estate planning, and the delicate balance between the two.

Your crash course in the new pension IHT landscape

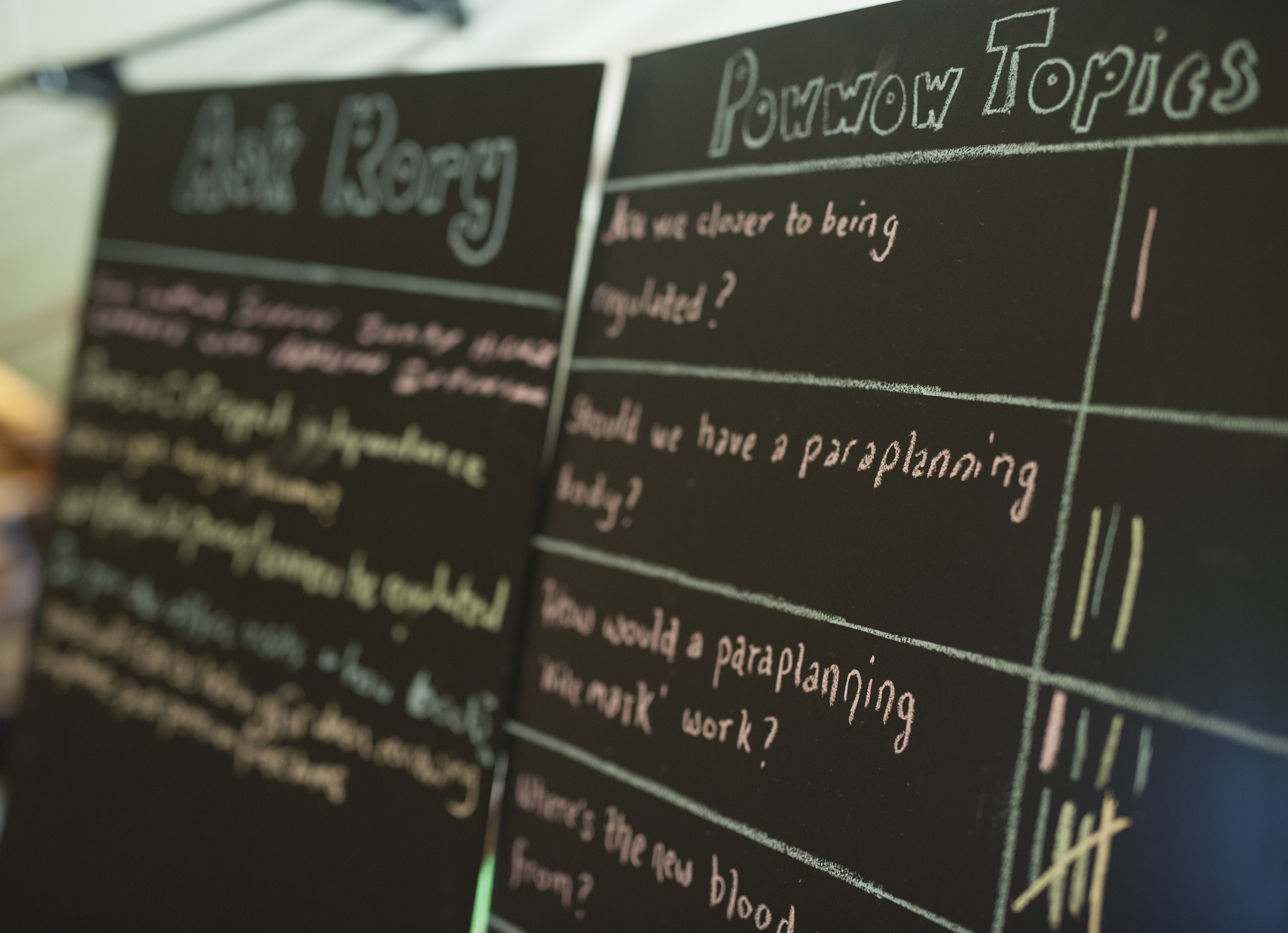

In what turned out to be an essential Assembly, we were joined by M&G’s Les Cameron to dive deep into the practical implications of these seismic changes. We strongly recommend reading M&G’s detailed response before watching the Assemly as it provides crucial context for our discussion.

During this Assembly, we evaluated the different options to mitigate pension-driven IHT liabilities, including:

- Are pensions dead? – separating the headlines from the reality for long-term retirement planning

- Is whole of life the answer? – when life assurance might fill the IHT gap

- Moving client money – the practical considerations of reshuffling portfolios

- Annuities vs drawdown – how the IHT changes affect this fundamental choice

- Bypass trusts – exploring whether trust structures can still provide solutions

What can you expect to take away?

You’ll leave this Assembly with a clear understanding of how the new IHT rules will work in practice and with strategies you can implement immediately to help clients navigate this changing landscape. We hope to give you the confidence to tackle those difficult conversations about restructuring retirement plans that took years to build.

Fair warning: there’s so much ground to cover that we may run slightly over our usual 60 minutes. If we do, we’ll schedule a follow-up session to tackle any outstanding questions.