Once upon a time, when taxes were relatively low, ISAs and unwrapped investments seemed like pretty obvious choices for clients’ money.

But the big cut in the capital gains tax allowance and rises in tax on gains and dividends has changed things. Tax wrappers that once seemed like more hassle than they were worth (like investment bonds) could now be the ideal vehicle – especially for higher rate taxpayers.

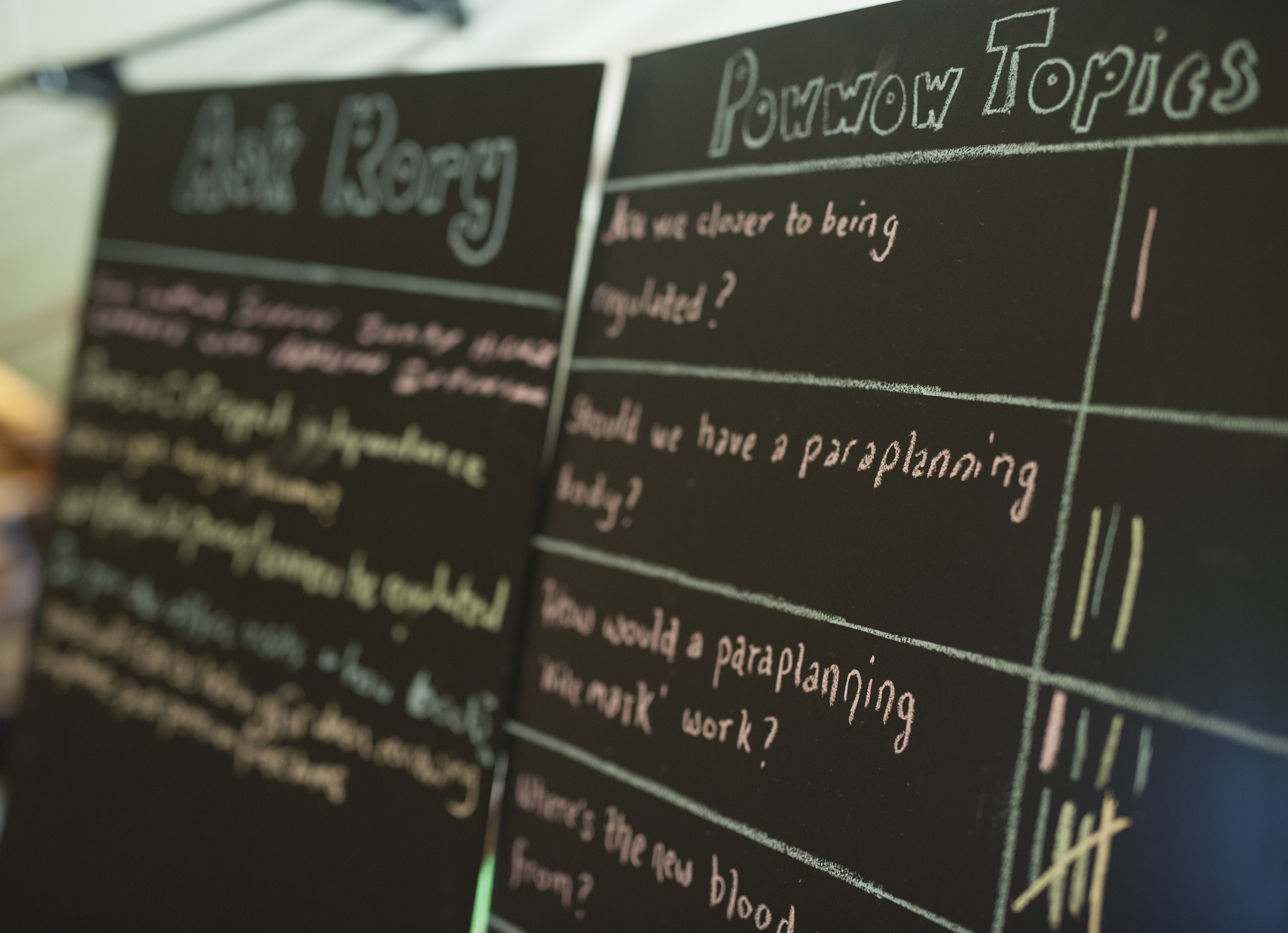

But which wrapper is right in which circumstances and why?

That’s the question that guest Neil Macleod from M&G’s technical team was invited to answer when he joined host, Leanne Pickering, for this Assembly.

What you’ll learn by listening

Over the course of one lunch hour, Leanne and Neil explored when bonds are more suitable, when offshore makes sense, and why the ‘best’ mathematical answer might not actually be the right choice for your client. In this Assembly you’ll:

- learn from real case studies that compare basic rate versus higher rate taxpayers

- find out how to use withdrawals strategically to fund ISAs

- discover why different asset types work better in different wrappers

- tackle those tricky questions about investing within trusts

- understand why paying a bit more tax sometimes makes perfect sense

You’ll discover that the right choice for your clients isn’t just about what the spreadsheet says but about the broader thinking

What’s more, once you’ve listened, follow the link below and you can request a record of 1 hour’s worth CPD too.