Now don’t take this the wrong way, but is there a chance that last time you put together recommendations or financial plans for a woman, the approach was unknowingly influenced by assumptions that generally apply to a man?

As paraplanners, we have the power to directly influence financial outcomes that are better for women – whether we’re reviewing fact finds, drafting recommendations, or creating financial plans.

But are we truly creating plans for the individuals in front of us? Or are we unwittingly relying on conventional thinking and assumptions which are actually more likely to be rooted in men’s experiences rather than women’s?

It matters because, more often than not, women’s financial lives are very different to men’s. So to deliver genuinely effective financial planning, it’s important to understand the differences and how to adapt our approach.

A chance to challenge your thinking

In the recording of this online Assembly, host Sam Tonks invited Sam Secomb of Women’s Wealth and Susan Hope of Scottish Widows to explore how paraplanners can better understand and address the unique financial planning needs of women.

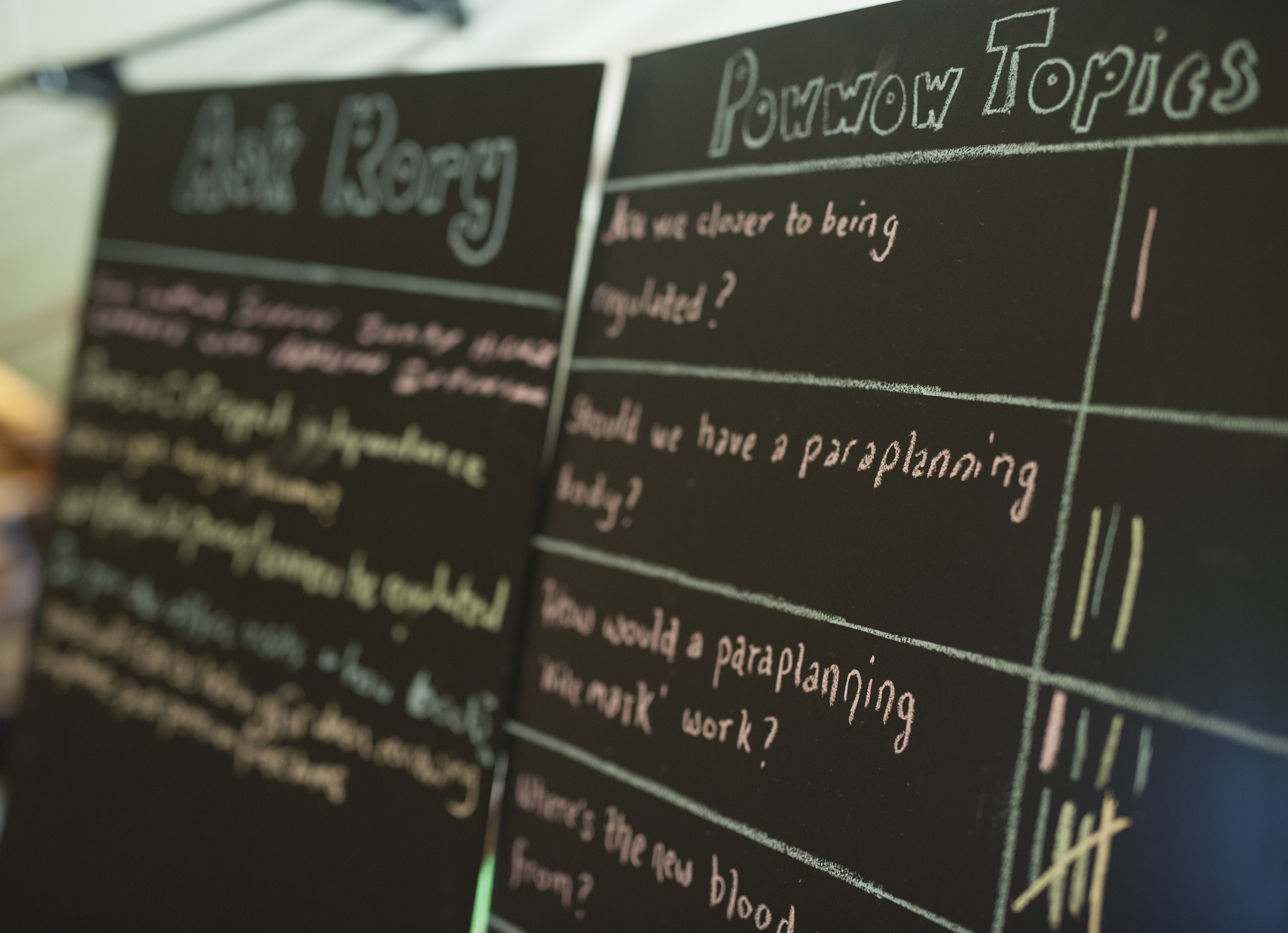

Together, they discussed women’s distinctive financial journeys and the stark disparities that exist – including the startling 30 per cent gender pension gap – and asked how paraplanners can help create better financial outcomes for female clients. During the session Sam, Susan and Sam discuss

– what makes women’s financial experience so different from men’s

– the real-world impact of the ‘parenthood penalty’ on long-term financial planning

– our assumptions about vulnerabilities, risk profiles and investment preferences

– practical strategies paraplanners can implement to better serve female clients

What will you learn from this Assembly?

You’ll gain actionable insights that we’re certain will help you improve your paraplanning approach, challenge conventional thinking and assumptions, and help deliver more tailored financial plans for your female clients.

Plus, you’ll discover practical tools and ideas so you’re equipped to improve financial outcomes for women right away.

Interested? Then tune in now.