From April 2025, the rules determining who pays UK inheritance tax are changing.

Instead of the complex domicile rules, a new ‘long-term residency’ test will decide whether someone’s worldwide assets fall into the IHT net.

Discover what’s changing

In this episode, Utmost’s international technical sales manager, Steve Sayer, explores how the new rules could affect clients in a range of scenarios – whether they’re UK residents planning to retire abroad or people returning home after years overseas.

Using worked examples, Steve demonstrates how changes affect trust planning, and explains when trusts might shift between excluded and relevant property status. He also touches on the implications of pension death benefits becoming subject to IHT from 2027.

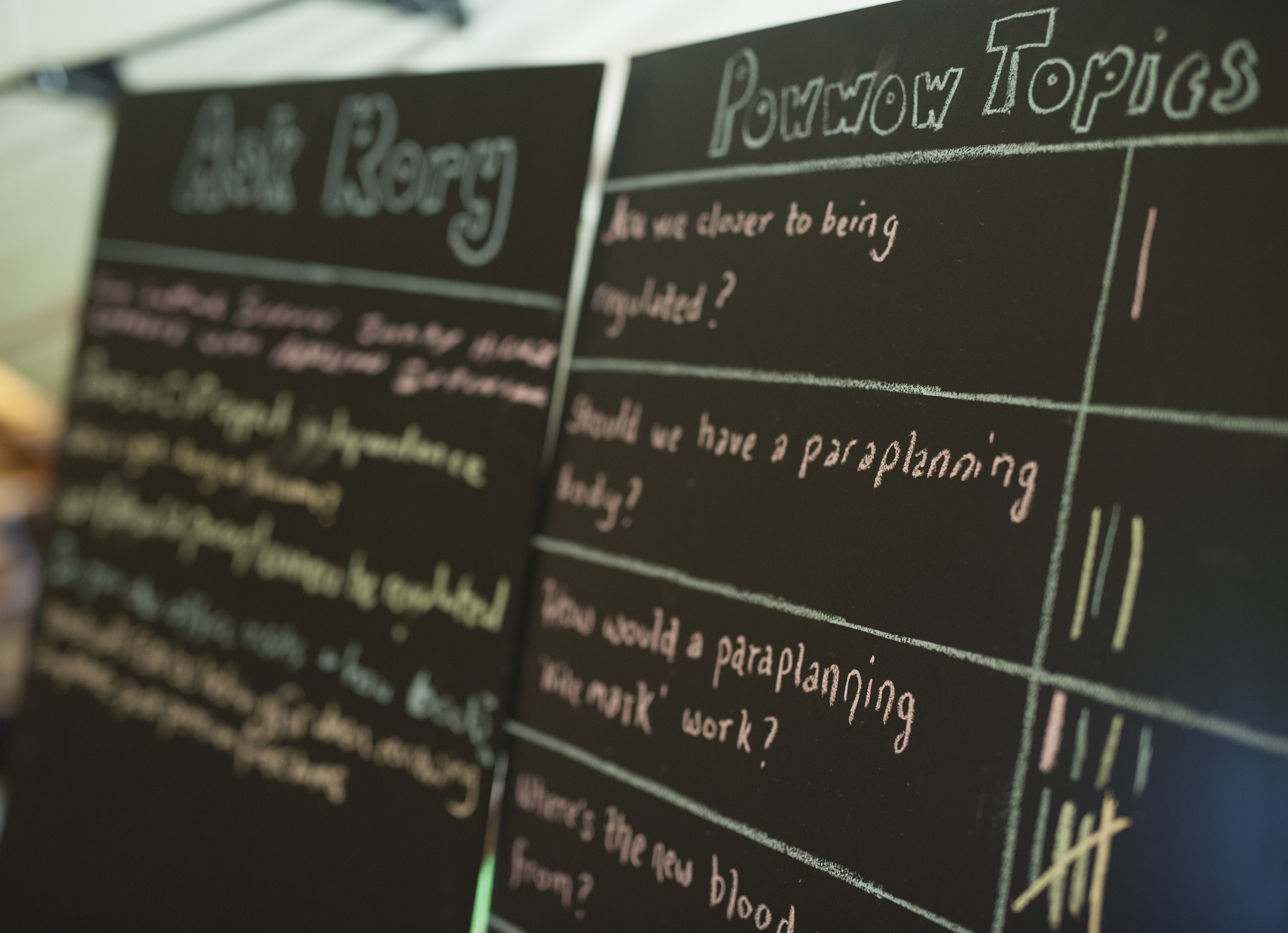

Who is this Assembly for?

Whether you’re already dealing with cross-border IHT planning or want to understand how these changes might create new planning opportunities, this session is a great way to get to grips with the new framework.

What are the learning outcomes?

By the end of this podcast, you’ll understand the post April 2025 changes to:

- Inheritance Tax; and

- The taxation of non domiciles

- How trusts can help to mitigate IHT liabilities

- Discuss and explain these with a client in a clear and concise way

- Apply this knowledge to appropriate, individual, client scenarios

Once you’ve listened, make sure you grab your CPD

CPD: Take the quiz to receive your certificate

Want to learn more? Then tune in now.