Richard Allum and Paradigm Norton’s Dan Atkinson get to grips with the topic of planning assumptions.

For what seemed like AGES, low interest rates and low inflation rates gave the impression that the factors affecting a client’s future were pretty predictable.

But more recently, roller-coaster interest and inflation rates, combined with pandemics and wars, could leave you thinking that the future is altogether more unpredictable.

But is it?

Assumptions that are fit for purpose

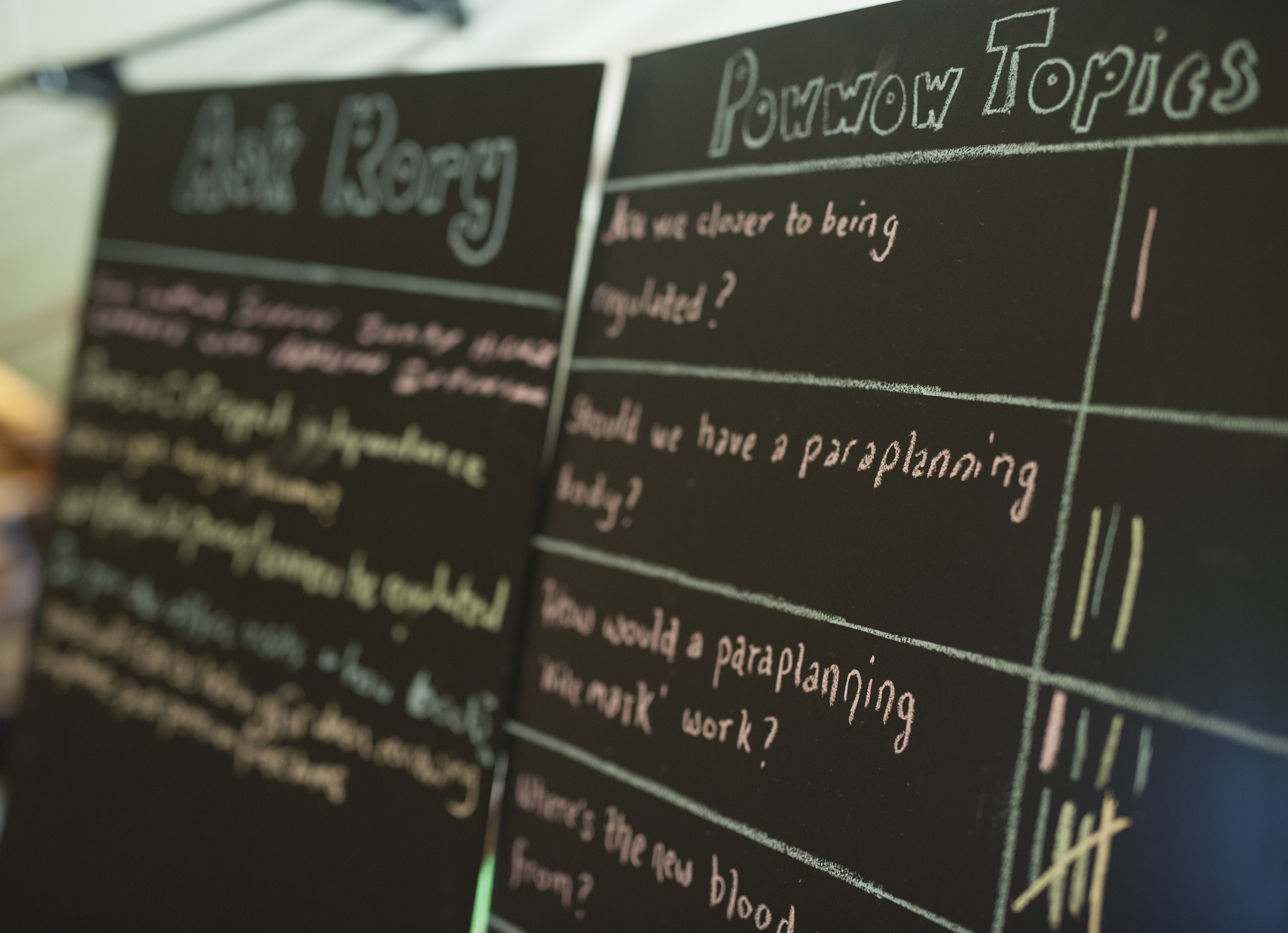

During this online Assembly, Dan and Richard explored ways to think about planning assumptions in future.

They considered the kind of indicators you can use to form a set of assumptions with the durability to withstand those periodic headwinds sparked by social, economic and environmental events – the kind that have dominated our lives lately.

Of course investments are important but healthspans, death, inflation, spending, retirement, care and more have the potential to feature.

And then there are clients with specific outcomes in mind to add to the mix – for instance, meeting school fees, saving to offset childrens’ university tuition fees or deposits for their first homes.

Don’t miss out

Tune in and you’ll discover you’re in good company. Not only is Dan responsible for Paradigm Norton’s financial planning assumptions, he also owns a crystal ball (he actually does) so – one way or another – he’ll have all bases covered.