We’re really pleased to announce that Sarah Lees and Sam Tonks will host the Paraplanners’ Assembly’s Big Day Out on 14 September 2023.

Sarah and Sam – along with a team of volunteer group hosts – will welcome as many as 100 participants to the annual gathering at FarmED near Chipping Norton.

This will be Sarah’s second time hosting the annual gathering of paraplanners – widely regarded as the world’s greatest paraplanning event (that’s held at a farm or farm-related location).

Sarah, who was crowned CISI’s Paraplanner of the Year in 2021, is a serial participant in the national Assembly.

In fact, this year’s Big Day Out will be the SEVENTH national event that the senior paraplanner from Mazars has taken part in during her 10-year paraplanning career – missing only the 2017 edition since 2016.

In marked contrast, for Succession Wealth paraplanner trainer Sam, the Big Day Out will mark a couple of firsts.

(1) It’s the 2020 Money Marketing Award Best Paraplanner winner’s debut as host of the national event; and (2) despite being a guest at online Assemblies, a participant (and group leader?) at the Big Day Out of this World and Big Day Out (In), PLUS organiser of this November’s Assembly In The Middle, it’s the FIRST TIME Sam will have attended the national gathering IN PERSON!

We know, right?! 🤯

Sam’s debut continues the tradition of inviting paraplanners with the desire to do so, the chance to host Assembly events.

That practice started in 2017 when Caroline Stuart hosted the – then – national Powwow in Aynho, Northamptonshire. Between 2013 and 2016, Assembly co-founder, Richard Allum, had hosted all four national events. Becca Tuck put in a virtuoso performance as the solo host in 2019 and, in 2020, Becca was joined on the beach at Paraplanners Paradise by Jonny Stubbs for the Big Day Out (In). The following year – so that’s 2021 – Jonny and Caroline Singleton landed on Paraplanet for the Big Day Out of this World. Jonny returned to Earth in September 2022 to co-host the Big Day Out with Sarah Lees. (Don’t worry, we didn’t leave Caroline on Paraplanet!)

Don’t leave it too late to grab your ticket!

Secure your ticket NOW for THE BIG DAY OUT on 14 September 2023 and, if you’d like to join us, the BIG NIGHT IN from 7pm on 13 September.

The BIG DAY OUT costs £35. Tickets for THE BIG NIGHT IN cost £20. For full event details and to grab your ticket

Want to get involved in hosting or supporting Assembly events?

Then take a look at our pages on hosting an event, organising a local Assembly and volunteering. If you fancy a go, get in touch!

For more than a year, and inspired by a suggestion by Tamnna Jethwa, the Paraplanners’ Assembly has been hosting a regular gathering for a small number of paraplanning team leaders and managers.

Meeting online every 4-6 weeks, the sessions give participants the chance to talk about the issues and topics that they share in common and influence their work. We’ve invited Becca Timmins – who facilitates the group – to share the conclusions they reached at a recent gathering on a topic close to paraplanners’ hearts: report preparation.

“The handover from advisers or planners to paraplanners when preparing reports.”

That was the answer recently offered by team leaders to this question ‘If you were to think of a process that needed to improve, what would it be, and how would you improve it?’. So we decided to dedicate some time in our latest meeting online to consider it.

Having led a paraplanning team in the past myself, it’s a process that I know team leaders (and paraplanners) continually seek to improve. And it’s a process that can often leave adviser and paraplanners alike feeling frustrated.

Because whether it’s a lack of available data or delays in getting hold of additional information, preparing reports can often become a complex process – when, in practice, it ought to be possible to keep it simple.

So what steps can you take to make it simpler?

In a moment, I’m going to share the five steps that our group concluded could help fix things but – first – it’s important to be clear about terms.

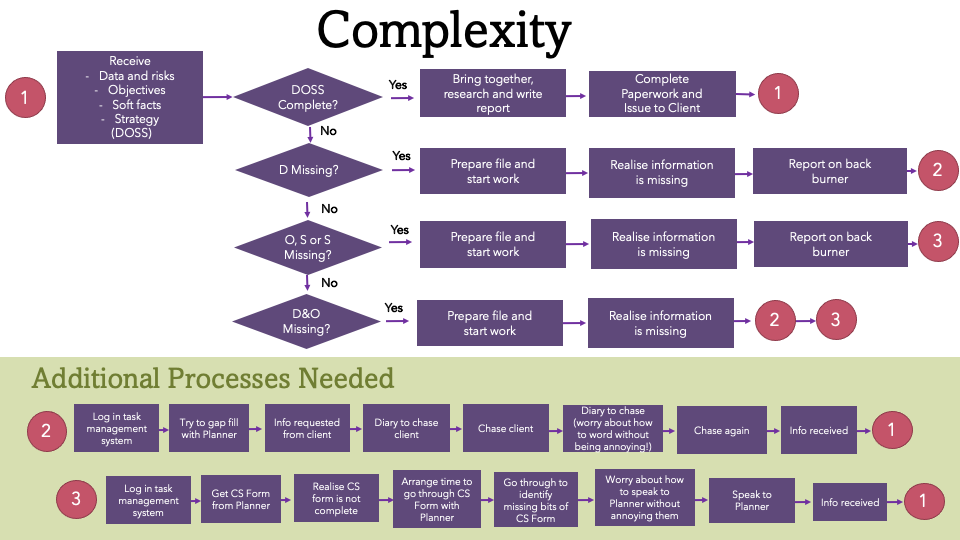

What’s the difference between a simple and a complex process?

A simple process is where you have all the information you need to gather your information, write your report and issue the report.

But when something is missing, the report process grinds to a halt, and it soon becomes a complex process.

A complex process involves additional steps such as logging missing information, chasing a consultant for information, diarising reminders and so on.

During this time, your brain is taking a journey: switching from one task to the next that involves various levels of starting, stopping, focus and switching – resulting in an as much as 20% loss of time, productivity and efficiency.

And applies to each project that’s complex so, the more complex projects you deal with, the less time you’re able focus on other projects.

Here are our key tips to ‘keeping it simple’ that we wanted to share with you

1. Get collaborative

The collaboration between an adviser and paraplanner is essential to complete a report, including understanding the information requirements to briefing process.

Both parties must work together to gather the data and information that’s needed to compile the report, either by working through the meeting notes or the paraplanner attending the client meeting themselves.

2. Keep it fresh

Diarise time to discuss the case with the adviser after their client meeting, so that information remains fresh. This will also provide help the paraplanner to complete the report, perhaps with a quicker turnaround (a win win for everyone!).

3. Make a checklist

Reduce the reliance on the adviser to check information.

Use a checklist to double-check all information is received so that the case is ready to be written, preventing any issues later on. Run through this at the briefing and highlight missing areas or information that wasn’t recorded.

4. Make sure everyone understands their role

The team should be familiar of each person’s responsibility in delivering the report. This helps to source and deliver the information in good time, and to understand the impact of delays.

5. Create a single ‘source of truth’

Establish one location where all information is stored so that it’s easily accessible and avoid the need for repetition.

The key takeaway from this session was the importance of collaboration between consultants, advisers, planners and paraplanners – especially when completing reports.

Would you like to learn and share more?

If you liked that, here are three things you can do right now which we think you might like too.

Take part in a power-up workshop

Becca Timmins is facilitating Personal development power-ups for Paraplanners – a 3-hour online workshop on 12 May.

» Book now

Share ideas in The Big Tent

Post questions, offer suggestions, and share your experience and expertise with other paraplanners in our discussion board: The Big Tent.

» Join the conversation

Meet up with other team leaders

Team leader? Then you can join our sessions too. But there’s a waiting list. To join it, tap the link and post a message at The Big Tent thread.

» Visit the thread

If you haven’t already discovered it, when you explore our new Resources page, you can search more than 6,000 minutes of video content from our previous online Assemblies. These are the top five most popular videos between 1-31 January 2023 – that’s based on the total number of views.

1. Top slicing relief: Planning strategies

Steve Sayer from Utmost Group talks about financial planning approaches to top slicing relief. Steve offers tips on avoiding incurring trustee rates of tax on gains, explains when new money should top up an existing bond or go into a new one, and suggest how to plan for ongoing income.

2. Getting started with SSAS

Rachel Geary of Barnett Waddingham explores small self-administered schemes (SSAS) and what paraplanners need to know.

3. What’s the right order of tax on income?

Do you know the order in which income tax is applied to different sources? If not, this Assembly with Les Cameron of M&G Wealth is for you. Even if you think you do know, we’re sure you’ll leave this Assembly older – by 45 mins and 32 seconds – but wiser.

4. Get into the right headspace for tax year end

Facilitator Becca Timmins is joined by Kez Condy and Jo Parkes from Navigatus, Zoe Hitchcock from Crowe UK and Emery Little’s Satu Flynn to discuss how they were getting in the zone for 2023’s tax deadline.

5. A plain English guide to old pension jargon: part one

James Jones-Tinsley of Barnett Waddingham and Richard Allum pick their way through the potpourri of jargon associated with old pensions contracts. This video is so popular, we’ve just recorded a new episode which we’ll publish at the end of this month – February 2023.

Today, we’ve published our most recent online Assembly on getting in the right headspace for tax year end as our very first podcast episode.

From now on, we’ll be publishing a podcast edition after each online Assembly – as well as bonus content from time to time.

In addition to the library of videos from more than 100 online Assemblies, it’s another way in which the Assembly hopes – no matter whether you’re a contributor or listener – you’ll be able learn things, fix things and share things that help you become the paraplanner you want to be.

Where can I find the podcast?

It may take a while for episodes to appear on your favourite podcast app but you can already find us on Spotify – and we’ve popped the episode below for good measure. (Depending on the privacy settings you accepted for our site, you may need to click a ‘Load content’ button for the Spotify player to appear.)

What’s in this episode?

Our first podcast episode features the conversation from our recent Assembly on getting in the right headspace for tax year end. Facilitated by Becca Timmins, the discussion involved guests with loads of in-house and outsourced paraplanning experience between them: Zoe Hitchcock from Crowe UK, Emery Little’s Satu Flynn, and Kez Condy and Jo Parkes from Navigatus.

With the upcoming tax year end deadline in mind, our guests tackled three questions:

- What went well at tax year end last year?

- What was a challenge?

- What will you take with you into this tax year end?

Tune in to hear paraplanners share their insights and experiences and perhaps you’ll pick up some ideas, tips and techniques you can apply to your own run in to this year’s tax year end.

We’d love as many paraplanners as possible to start your own Paraplanners’ Assembly – however and wherever you’d like.

But don’t feel you need anyone’s permission to create your own event because, just as Tim Berners-Lee once said about something else: ‘this is for everyone’.

What we would like to do is support any Assembly as much as we can. So here’s a few tips on how to start your own Paraplanners’ Assembly.

Let’s start with the organising principles behind the Paraplanners’ Assembly and how this might apply to your very own event. Then, we’ll explain the practical ways in which we can help one another and support your successful Assembly.

The spirit of the Assembly

The Paraplanners’ Assembly stemmed from a simple idea:

To provide a place where paraplanners can meet to exchange views about the future of our profession, to learn things, to fix things and to share things.

We’d love to see Assemblies – no matter how large or small – adopt that self-same spirit that led to the very first event. (So keep that thought at the back of your mind throughout.)

The six organising principles of the Paraplanners’ Assembly

We’ve adopted some ‘organising principles’ that we think give our events their distinctive character. If you’re thinking of putting on your own Assembly, here’s what they were:

1. (At least) two’s a crowd

Take inspiration from the organisers of other local Assemblies and share the load: Find at least one other person you know and organise the event together. And if you can’t find someone, let’s see if we know anyone you can partner up with.

2. Assembles are not-for-profit events

That’s right. Assemblies are voluntarily organised by paraplanners.

Every penny that participants and supporters part with is invested entirely on making the Paraplanners’ Assembly possible.

Our ambition was to create a place where paraplanners could meet at the lowest possible cost. And, ideally, the lowest cost would be ‘Free’. That’s what we suggest for local Assemblies.

3. Assembles belong to paraplanners

We adopt an ‘unconference’-style format. This means that, in advance of the event, participants get to pick the topics they want to talk about and decide on the priority through voting.

Organisations or brands who are supporting your Assembly should only contribute to discussion about topics that paraplanners themselves have determined or participate in ‘the spirit of the Assembly’, which we mentioned above and doesn’t mention ‘pushing our products and services’.

4. Assemblies are unwaveringly independent

What we mean by that is that the Assemblies are not forums in which organisations or brands can pitch-up and flog their wares.

Because the event is designed by paraplanners for paraplanners (see 3, above), it’s paraplanners who decide what’s on the agenda rather than being subject to the agenda of others.

Organisations and brands supporting Assemblies are precisely that: supporters (not sponsors). Sponsorship brings with it certain rights for sponsors, whereas being a supporter brings no rights at all.

But that doesn’t prevent direct involvement in the event by supporters of Assemblies, so long as their participation is in keeping with the spirit of the Assembly: ‘To provide a place where paraplanners can meet to exchange views about the future of our profession, to learn things, to fix things and to share things’.

5. Participants – not ‘delegates’ or ‘attendees’

Assemblies aren’t events that are put on for people; people are the Assembly, so make sure people realise they’re there to take part before they turn up!

6. Wherever possible, chocolate and top-notch sweets should be provided

Because life’s a box of chocolates; not a saucer of boiled sweets.

6 practical ways to a successfully organise your own Paraplanners’ Assembly

1. We’re all in this together

As soon as you’ve resolved to set up an Assembly, feel free to get in touch by e-mailing [email protected].

We’ll set up a project for your Assembly using a bit of kit called Basecamp. Basecamp provides an online space where organisers of your Assembly – no matter how many there are and where they are in the country – can decide on things, set tasks and keep tabs on progress without clogging up your e-mail.

It means that everyone, who needs to be, is in the know about your Assembly’s organisation.

2. Our survey said…

Because Assemblies are designed by paraplanners for paraplanners, you’ll need a tool to gather opinion from potential Assembly participants on subjects from the preferred date and location of a Assembly, to voting for topics to discuss on the day.

To do this, we use the survey tool, Typeform, and we’d be very happy to set up surveys for you.

3. Where in the world-wide web?

Your Assembly will need its own page on the web where people can find out information and book their spot at your event, so we’ll build you one here at paraplannersassembly.co.uk.

And, speaking of booking a spot…

4. The future’s Eventbrite

For the Paraplanners’ Assembly, we used the online event management tool, Eventbrite, to handle all the ticketing and bookings and cancellations and wait-list and delegate lists and all that palaver. Eventbrite’s brilliant, so we’ll set up an Eventbrite page for your Assembly – which will include a gizmo to plug-in an online booking form for your Assembly’s page at paraplannersassembly.co.uk.

5. Getting the word out there

We’ve been in this game for some time and have accumulated quite the following hair flick. We’ll help you get the word out there on our social channels and before you know it, they’ll be hammering down the door.

6. We’ll send e-mail for you

(We couldn’t think of a snappy title for this bit.)

We’ll help you raise awareness for your event with all of our email subscribers. We don’t mean to boast but we have quite the subscription list.

And once you’re ready to roll, we’ll help you communicate with people who have signed up with the essential information for coming along the the event.

So that’s it.

If this has piqued your interest why not get in touch about organising an Assembly? Just e-mail us at [email protected].

At the beginning of 2021, we asked paraplanners where they’d like us to focus this year. ESG was in the top five topics requested by paraplanners. So, we ran an ESG special in August and included it in our national event, the Big Day Out of this World.

At both events, we were joined by ESG specialist, Rebecca Kowalski. Her passion and knowledge of the topic helped breath life into the subject.

Rebecca has since set up Overstory – a consultancy with the aim to equip people with the tools, materials and communications they need to have conversations about sustainable investing with clients.

Meeting so many paraplanners at the two Paraplanners Assembly gatherings this year, has given Rebecca food for thought and she shares her thoughts here.

Over to Rebecca….

From Outerspace to Overstory

I had a really great time talking to Paraplanners about ESG at the Paraplanners Assembly “Big Day Out of the World” in September. Over the last couple of years, with my former employer, my career path has launched me to Planet Compliance and Planet Sustainable Investment and Paraplanning was beginning to seem just a distant star in the sky. Talking of stars however, I have a lovely shiny one on my window sill, in the form of the Paraplanner of the Year Award 2008, which is how I first met Richard Allum. Yes, I have been orbiting in the Paraplanner galaxy for that long! There have been other awards since then, but that first one always shines the brightest.

But back to the present and the Sustainable Investment mission has in fact been so successful that I ended up on a solo journey and decided a couple of months back to launch my own business, Overstory Finance. Sustainable investing has really gripped me and after over 25 years in financial services, I have never been so proud and excited about what I do. My former employer encouraged and appreciated my enthusiasm for the subject and noted how it made things happen in the business, rubbing off on colleagues and clients and bringing in recognition for the firm’s sustainable investment portfolios. We were in fact planning to go where no IFA had gone before with the proposition. However, ownership of the business changed and I decided to thank them for their support, wish them all the best and take a small step for the planet and a giant leap for my career development by steering my own ship into the unknown.

Reach for the Tree-tops

So, here we are on the good ship Overstory. If you don’t know (as I didn’t, until my husband made me read his “tree book” earlier this year – “The Overstory” by Richard Powers), Overstory means the forest canopy, the tallest trees that grow higher than the others to reach the open sky. Given I have been affectionately called the office “tree-hugger” in my time, the tree theme appealed to me and also, all Paraplanners like to tell a good story, right? I haven’t finalised my official business mission statement yet, but the unofficial version would go something like this:

“Determined to use our sustainable investment knowledge, experience and passion to make the biggest possible difference to the financial services industry, to client experience and to the world we all share. Feel good finance for a finite world.”

In practice, this means that I aim to share and put to good use all the hands-on experience I have had, all the huge amount of learning I have done and all the ideas I have chased around my head at midnight through the long months of lockdown. I have spoken to a lot of FS people about the barriers that deter advisers from embracing sustainable investment and have identified a number of ways in which I can help remove these. These services will all be listed on my web page which is coming soon.

The Overstory Guide to Sustainable Investing

An early chat with a very kind sustainable investment idol of mine, Kaisie Rayner, got me thinking about writing some training/ learning materials and this idea was re-ignited at the Paraplanners Assembly Big Day Out of this World. Getting the chance to speak to so many people in a small space of time, I realised that there was a real appetite for knowledge about how to do ESG, ethical and sustainable investing well among the Paraplanner community. This shouldn’t of course be any surprise to me, as I should know from experience that no-one likes to do things well more than a serious Paraplanner!

After taking a slightly hell for leather, scattergun approach to building expertise in sustainable investing and matters related to it, I think I can make it easier for people in the financial advice profession who wish to understand the underlying themes, the investment strategies, the regulations, key issues and debates and suitability and compliance considerations relating to sustainable investing.

Having studied and gained some useful knowledge from the CFA Certificate in ESG Investing, I am aware that its method of assessment is very much focused on the role of an investment manager or fund analyst. In my mind’s eye, I see the Overstory guide to sustainable investment advice (don’t worry, a better title will evolve) as focused on the knowledge and practical skills necessary to understand, apply, and explain the theoretical concepts related to ESG, ethical, responsible, sustainable and impact investing. It should cover how to be prepared for client conversations, how to build a robust sustainable investment proposition and how to meet compliance requirements. Crucially for me, it should also take a very honest look at things like greenwashing and the authenticity of all the talk about how much finance can save the planet! We should ask these questions of ourselves, before either a sceptical colleague or a client raises them.

Roots and branches

Following the Big Day Out of this World, I exchanged a couple of messages with Alyson Brooker of The Paraplanners and want to thank her for the insight she gave me into what type of learning would interest her. It was really encouraging and informative. I have therefore asked the Paraplanners Assembly if they would help me connect with the wider paraplanning community to explore what you would like a text/ course / training to look like. If we go back to my tree obsession, lets take a roots and branches approach and then we can all reach the canopy of sustainable investing expertise together.

I have already enlisted the help of Alan Whittle to work with me on delivering the learning materials and we are both keen to start on this rewarding project. Alan is a former Paraplanner and Compliance Officer who now works as a researcher, lecturer, trainer, and provider of external compliance support for financial planning firms.

We would be delighted to gather your thoughts on your learning needs and see what we can do to help meet them. Please answer 12 simple questions here.

Thanks Rebecca and good luck with your new venture. We’d encourage anyone interested in this topic to share their thoughts with Rebecca.

Our friends at Aegon are doing a lot of work around financial wellbeing. Dr Tom Mathar, Centre for Behavioural Research, Aegon UK and one of the experts on this online assembly, would like to share some thoughts with you.

Life is unpredictable and changes constantly. But what remains is our need for financial security and peace of mind. And with the rise of DIY platforms and robo-advice breaking through an industry focusing on three things – alpha, asset allocation and charges – the value of advice needs to go further. That’s where financial wellbeing can play its part.

So what is financial wellbeing?

Financial wellbeing is how people feel about the control they have over their financial future – and their relationship with money. It’s about focusing on the things that make their life more enjoyable and meaningful – both now and in the future.

What we focus our mind on matters

Everyone’s idea of financial wellbeing is different – from having enough money to live comfortably, making large purchases (planned or unexpected), to being able to repay outstanding debts, as well as being on track with savings and pensions to cover later life.

But you can easily break financial wellbeing down into two things for your clients:

- Financial resilience – do they have enough to pay for what they need now and in the future.

- Focus – are they paying attention to what really makes them happy.

Financial wellbeing building blocks

We found that money building blocks and mindset building blocks are necessary to build financial wellbeing.

As part of our latest research[1] we asked people about their financial resilience and their ‘mindset’ – how they think about money, and we created a scale to help clients picture it:

5 money building blocks

- Income

- Rainy day fund

- Manageable debt

- Smart long-term savings

- Valuables that make us feel secure long term, like property

5 mindset building blocks

- Knowledge of what makes us happy

- A solid picture of our future self

- Savvy social comparisons

- A long-term plan

- Strong nerves in a crisis (resilience)

But it’s also about balance. Even if your clients have their money building blocks nailed, they won’t achieve optimal levels of financial wellbeing without a well-considered and focused mindset too.

What was clear from our research was that mindset scores were lower than money scores, and the mindset scores didn’t improve at the same pace as peoples’ incomes were.

Common mindset problems

Lower mindset scores were a result of several factors including:

- 38% of people have only a vague idea of where they want to be (financially, socially, physically etc) in 10 years’ time vs 29% with a specific idea.

- 28% have only a vague sense of what gives them joy or purpose which are key elements of happiness.

- 87% of people don’t have a financial plan to achieve long-term goals.

- 16% of people frequently compare their finances to the finances of those better off than them with younger people far more likely to do so.

- Only 17% of people were able to answer at least four out of five basic financial literacy questions correctly.

Five tips to adjust your client’s mindset and improve their financial wellbeing

Use the tips below with your clients to reframe your conversations and check-ins and encourage them to think about what gives them joy and purpose.

- Ask them to put happiness first – alert them to be conscious of the things that give them sustained happiness – be that joy or purpose. And that they’re spending time, energy and money on those things with their future happiness in mind.

- Savvy social comparisons – if they’re making social comparisons, encourage them to be healthy and realistic, instead of them comparing to people whose financial lives appear better. Or even suggest they use their past self as a comparison to measure how far they’ve come.

- Help them picture their future self and lifestyle – encourage your clients to spend time regularly visualising their future self and what they might be doing. By paying attention to the life they want to live, pension and investment goals to achieve that lifestyle, can keep them on track. It’s also important for your clients to think about what protection they have in place if something unexpected derails them.

- Make a long-term plan together and write it down – people who write out a financial plan save more regularly and do better financially.

- Reassure them to hold their nerve in a crisis – if your clients are tempted to change their long-term investments, get them to remember why they started saving so they don’t panic and do anything they might regret.

Get started

We’re committed to working with you to help identify advice opportunities and support your clients throughout their lifetime.

To read our research in full and share with your clients, download our digital flipbook – How you can improve your financial wellbeing

We’ve also created a summary guide of the research – Our insight into the nation’s financial wellbeing – designed especially for intermediaries, paraplanners and employers.

For other financial wellbeing support and research, visit aegon.co.uk/financialwellbeing

[1] Research conducted in August/September 2020, based on 10,466 nationally representative UK residents

Did you nearly get RSI writing down all the research and analysis tools paraplanners rate in this online assembly? If you missed a few or just couldn’t keep up, you are in luck as we have popped them all down here.

Plus if you missed the actual live event, watch it here to find out more on why we rate these tools and what we find them useful for.

Fund research

- FE Analytics (helpful assemblies on this tool are here and here)

- Trustnet

- Morningstar

- Fundecomarket

- Worthstone (Their next Impact Investment Academy is on Tuesday 16th November 2021 and can be found here)

- Ethical Screening

- DD|hub

Wrapper and product research

- Langcat Platform Analyser

- WrapCompare

- NextWealth Directory

- Synaptic

- Defaqto Engage

- Tax Efficient Review

- MiCap

- iPipleline (Assureweb)

- Iress Exchange

- CI Expert

- Selectapension

- Boring Money

Technical researcH

- Big Tent

- Standard Life Tech Zone

- Prudential

- Old Mutual Wealth

- Royal London

- Techlink

- HMG & HMRC

- ONS

- My Care Consultant

- Law Society IHT Handbook

Financial planning

These are sites to find out general information and do analysis and planning research.

- Prudential Tools & calculators

- Royal London salary sacrifice calculator

- Age UK

- TFP Calculators

- Listentotaxman

- The Salary Calculator

- Reverse Tax Calculator

- State Pension Age Calculator

- ONS Life Expectancy Calculator

- Money Advice Service

- Mortgage Overpayment Calculator

- Royal London rates & Factors

- Just CY calculator

- Invidion

- Vanguard Pension Calculator

- BOE inflation calculator

- Voyant

- Cashcalc

- Moneyscope

- Timeline

Others

Remember, you can watch the show here and if you have any more questions, people are always happy to help on the Big Tent.

In November, Susan Pringle was joined by Dr. Tom Mathar of Aegon UK to explore behavioural science. You can watch the replay. We enjoyed the Online Assembly so much that when the team at Aegon shared an article about the effect of working with clients in an online environment, we thought it would make an interesting follow up.

So…once more, over to Dr. Tom..

The online encounter

Why clients are more comfortable with an online relationship than you may think

Coronavirus forced many of us to move out of our carefully arranged offices into a home environment and made video calls more prevalent. And with that move, advisers and paraplanners are now faced with the challenge of trying to acquire new clients from their own homes.

The physical cues normally used to get messages about themselves and their business across may be lost. Clients, however, will continue to look for these cues that ultimately encourage them to build trust. So, it’s important to carefully think about the messages the background of video calls can convey.

Subliminal messaging works

The norm of reciprocity means clients are more likely to give away something personal (their concerns, requirements, hopes and aspirations) if you share something personal too – either implicitly or explicitly.

In 2020, we asked 2,100 members of the Aegon Feedback Community what should present itself in the background of a video call – most of our respondents said it should be ‘clean’. Although references to achievements and professional background (for example, awards and certificates) are considered acceptable too.

But subconsciously, sharing deeper personal references such as family connections, seems a more powerful way to enter a reciprocal relationship.

Our study also suggests that using references to your personal wealth or social status (for example, exclusive art or interior design) could stop prospective clients from entering a relationship with you[1]. Similarly, blurring the background could also put you at risk of not building an open, trusting relationships with clients. This, however, may differ with the client segments your firm typically serves.

Share and share alike

The TrustedAdvisor’s Trust Equation[2], uses four variables to measure trustworthiness:

- Credibility (which has to do with the words used in client interaction);

- Reliability (which has to do with actions);

- Intimacy (relates to the safety / security we feel when engaging with someone), and

- Self-orientation (refers to your focus and, more specifically, if you seem focussed on the client or yourself).

Of all four, intimacy is considered the most powerful component. Intimacy refers to the sense of security that someone gets when they engage with you. They want to know that everything they share with you will be treated with respect and propriety.

In our report Building trust with prospective clients, we look further into the Trust Equation – how only by giving something will you likely get something back, and by sharing your own hopes, fears and aspirations you will invite the same from your clients – and how this can help to develop a deeper understanding of their financial motivations.

How you and your clients adapt

Pollster Opinium[3] found that the majority of advisers (59%) said that ‘working with clients remotely’ is the main challenge they’re currently facing when adopting to Coronavirus disruption.

Before the pandemic, 84% met their clients in a face-to-face encounter ‘often’ or ‘very often’ and only 7% used video calls. Going forward, 70% assume they’ll meet their clients face-to-face ‘often’ or ‘very often’ – and 38% say they’ll meet clients using a video call.

Opinium’s research also found that clients would now prefer to meet their adviser in a video call after the pandemic, rather than return to face-to-face meetings as they become increasingly more at ease with the idea of an online relationship.

And in our own research, crucially, those who think this are the Career-driven families and Upper Echelons customer segments, who have significantly higher assets than average and are more likely to work with an adviser.

Summary

It’s likely that video calls will continue from now on, so it could be worthwhile thinking about which supportive cues are right for your clients and business’ brand.

And it’s worth noting the variables in the Trust Equation have become much tricker to manage with the move from office to online meetings. In a video call it’s a careful balance between conveying the right levels of intimate messages about yourself without seeming as if you’re pushing your own goals onto your clients. Getting the right blend can have a significant impact on client trust and your business.

You can read more about the research and our findings in our two reports:

Increasing client trust during video calls

Building trust with prospective clients

[1] Aegon Feedback Community, 2,100 respondents, 2020

[2] trustedadvisor.com, the Trust Equation, 2020

[3] Understanding the impact of Coronavirus on the investment landscape. Opinium, 2020.

Thank you Dr. Tom and Aegon UK. 👍

We like a collaboration, and that’s exactly what we’re doing with Aegon where we’ll cover tax topics in these video shorts. Think tax topics cut into easily bitesize videos that you can watch on the go.

Whizzing us through the tax topics is Elaine Cruickshank.

Elaine is a qualified account and member of STEP. She is Tax and Trusts Manager in the Aegon retail sales team and has been with Aegon for 17 years. She provides tax and trusts support to the Aegon retail and protection sales teams and advisers. She is Aegon’s tax and trusts spokesperson – writing articles, delivering webinars and presenting at seminars.

There’s five videos to dive into covering:

- Capital losses

- Taking money from a bond

- Shares and capital gains tax

- Scottish rate of income tax

- IHT planning

So, don’t delay, get watching and if you find these useful let us know and we will make some more.

So what can you expect from a technical short?

Here’s Richard to explain what you can expect from this series.