Aegon UK’s Sarah Purves and Succession Wealth’s Ellie Welling return for a follow-up to last month’s ‘What kind of paraplanning leader will I be?’ Assembly.

Picking up where they left off in November, Sarah, Ellie and host, Richard Allum, explore a topic that every aspiring and existing leader will experience during their career: difficult conversations.

Sarah shares ideas and techniques that can help paraplanning leaders successfully prepare for and navigate discussions that you might otherwise dread.

During the second half of this episode, our guests focused on questions, ideas and topics raised by paraplanners during the first Assembly.

But whether or not you joined Sarah and Ellie last time, and haven’t had a chance to listen or watch it on catch up yet, you’re sure to gain plenty to inform your reflections on successful leadership by tuning into this discussion.

Watch or listen now

So if you’re on the lookout for an hour that’s packed with practical ideas and insights that could prove vital to your next steps in paraplanning, look no further.

Perhaps you’ve been thinking about stepping into a leadership role in paraplanning. Or you’re already managing others and want to build your skills. Either way, our specially extended lunchtime Assembly at 12.30pm on Wednesday 13 November is for you.

What’s in it for me?

Over 90 minutes, you’ll explore what kind of paraplanning leader you could be and discover how you can make that step with confidence – all from the comfort of your own desk (or canteen, cafe, or kitchen table).

Wherever you’re joining from, we’ll have Aegon UK’s learning and organisational consultant, Sarah Purves, on hand to help. Throughout the Assembly, Sarah will be inviting you to try out a series of exercises that will help you:

- Identify the paraplanning leadership qualities you already have (you might be surprised)

- Discover your natural management style by learning from what’s worked (and what hasn’t) with your own managers

- Get better at those tricky conversations that come with leading others

- Build a practical toolkit you can use straight away to have more impact in your role

What’s more, Sarah will be joined by paraplanner Ellie Welling from Succession Wealth who will be sharing her own experience of moving into a leadership role – what she’s learned, what she wishes she’d known, and how she’s gone about developing her own approach to managing a team.

It’s an Assembly that’s specially designed so you can:

- share your thoughts about the challenges of leadership without judgment if you’d like to

- learn from the experience of others at different stages of their career

- gain practical tips you can actually use right away

- work out if leadership is right for you and what it could look like

- ask questions you’ve always wanted to ask about managing others

Save your spot now

There’s no magic formula for becoming a leader. But there are tools and techniques that really work. Whether you just want to tune in to listen and learn, or get stuck in and share your thoughts in the Chat, you’ll be really welcome.

So how about it? Save your spot now.

Don’t miss part two!

This Assembly was the first of a two-parter on paraplanning leadership. In the second part, Sarah, Ellie and Richard will dig into dealing with difficult conversations as well as exploring the questions raised in the Chat at today’s Assembly.

To save your spot for that Assembly, visit the event page.

Scottish Widows’ pensions specialist (and Big Day Out 2024 ‘Quiz the Expert’ alumnus), Gareth Davies, joins host, Richard Allum, for the follow-up to his popular ‘Is there a recipe for successful retirement income advice?‘ Assembly which we held back in June.

Why a second helping?

An unbelievably busy Chat meant that Gareth fielded a fair few comments and questions which left too much ground to cover in just one lunch hour. So Gareth agreed to come back later in the year to conclude his survey of the retirement advice landscape.

In this concluding Assembly, Gareth and Richard…

- Revisit the annuities vs. drawdown debate – examining the case for ‘annuities plus drawdown’, exploring the latest annuity features, and discussing strategies for annuitising fully crystallised pension pots.

- Dig into pension death benefits: they’ll consider the options and potential pitfalls of death benefits – plus focus on the importance of nomination forms and their regular review.

- Assess the effect of regulatory change: if there’s time, they’ll consider how the FCA’s thematic review is influencing retirement income advice, what it may mean for centralised retirement propositions, and what it means for your ongoing assessment of suitability.

It makes for a lunch-hour Assembly that’s packed with valuable insights and practical ideas that you can apply to client cases right away.

You can’t beat a good case study or two for discovering and consolidating technical knowledge, insights and practical ideas.

So you’re going to love this special episode in which Steve Sayer of Utmost International explores not one, not two, but three case studies that – together – spotlight essential planning considerations for clients who have spent time overseas, and have invested abroad or hold offshore bonds.

Because in this hour-long case study investigation special, Steve steers us through time apportionment relief, personal portfolio bonds and deficiency relief.

Time apportionment relief: The lion’s share of the recording focuses on time apportionment relief – a vital consideration for clients who spend time abroad or return to the UK with existing investments. Steve shows how pre- and post-2013 rules can significantly impact tax calculations, explores the potentially valuable concept of ‘material interest periods’ and covers plenty more besides.

Personal portfolio bonds: Using case study scenarios, Steve illustrates the potential pitfalls of non-compliant policies and the hefty tax implications of deemed gains.

Deficiency relief: Steve offers a comprehensive overview of the applications of deficiency relief and considers its limitations.

It’s no accident that Steve’s sessions are some of the most popular among paraplanners. His forensic knowledge, clarity of explanation and use of case studies bring topics to life and make episodes like this a must-watch or listen.

Grab your CPD

Scroll down the page and you’ll find links to receive a certificate for your CPD records plus a link to download a copy of Steve’s slides.

Perennial Assembly favourite, Les Cameron of M&G Wealth, joined us to share his thoughts on Labour’s Budget on 30 October.

As well as the fact that Rachel Reeves made history by becoming the first woman to deliver a budget as Chancellor of the Exchequer, were there measures that are sure to feature when Budget history is written?

Or were the widespread jitters among savers and investors ill-founded as Labour delivered its first Budget since Alistair Darling’s on 20 April 2010 – no fewer than 5,334 days earlier.

What actually happened?

Were the headlines screaming about capital gains and inheritance tax? How about pension tax relief and fuel duty? Or national insurance and the British ISA? Perhaps even VAT on school fees or measures affecting non-doms? And what about a wealth tax?

Les was on hand to offer his thoughts and insights, and address lots of questions and comments posted by paraplanners in the Chat.

So did it turn out to be one of the most consequential Budgets of recent years? Was it more of a ‘pitch-rolling’ statement in preparation for future measures? Or something else altogether?

Tune in and find out.

What steps can you take to make sure your client’s plan will deliver a reliable income in retirement nowadays?

After all, it’s an area of advice that is coming under some significant regulatory attention. Because not only is it the subject of a thematic review but the arrival of The Consumer Duty has also turned the spotlight on the suitability of advice too.

Retirement income advice: why all the fuss?

The last few years witnessed big challenges for paraplanners seeking secure incomes in retirement for clients thanks to significant economic and political events.

First there was pension freedoms and the surge in drawdown strategies. Next, rising inflation and interest rates conspired to squeeze income during the cost of living crisis. And that crisis prompted the search for secure income and a revival of annuities.

The paraplanner’s dilemma

But what’s the right balance between drawdown and secure income strategies? (Is there a balance to be struck at all?) What steps can you take so your client won’t simply run out of money? And how can you be sure that the FCA will agree that your approach to retirement income is consistently suitable?

Patrick’s practical planning pointers

That’s where our guest expert at this Assembly, Parmenion‘s head of strategic partnerships, Patrick Ingram, comes in. Because Patrick shares some practical ideas that you apply straightaway to cases, and offers insights that will help you think through the planning challenges.

Among the areas that Patrick and host, Richard Allum, cover in this lunch-hour Assembly are:

- analytical drawdown advice for clients spending money in retirement

- why managing drawdown is different to wealth management

- the importance of secure income ratios in drawdown planning

- the ‘4% rule’ versus current annuity rates

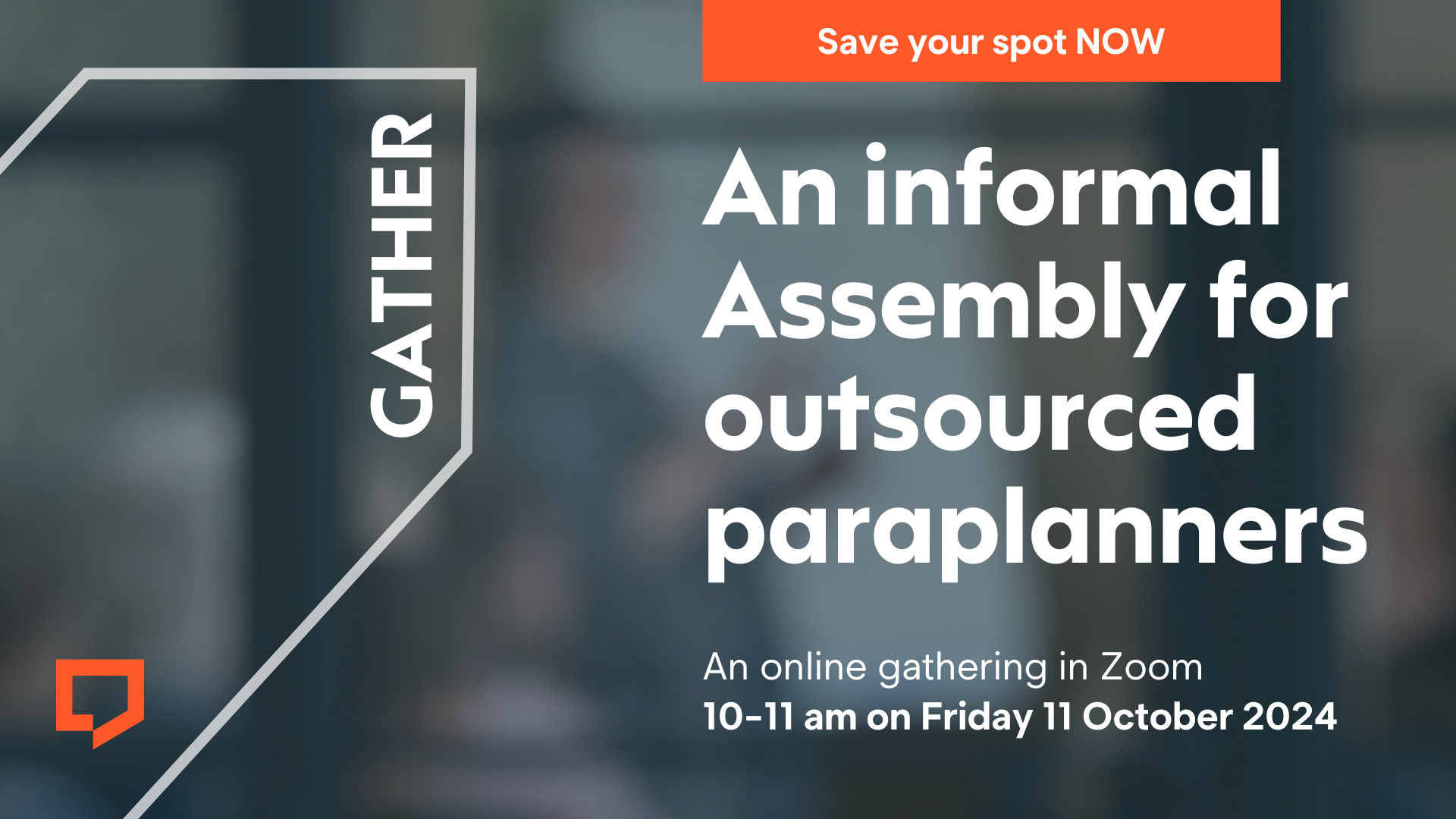

Are you an outsourced paraplanner?

Whether you’re the only employee of your paraplanning practice, or you lead a paraplanning powerhouse with employees and a hefty bank of clients, outsourced paraplanners share lots of things in common.

You just do.

But here’s the thing: despite the growing number of outsourced paraplanners in the UK these days, opportunities to get together to talk only about things that matter in the outsourced world, are surprisingly few and far between.

Switch off. Show up. Join in.

So, if you’re an outsourced paraplanner, here’s our invitation: at 10am on Friday 11 October 2024, set your notifications to ‘do not disturb’, click on the Zoom link in your event invitation and gather with other outsourced paraplanners across the UK for an hour of conversation, ideas and practical insights.

There’s nothing to prepare. Just come along ready to share your answer to one question:

‘What’s on your mind today?’

Spaces are limited. To save a spot hit ‘Book Event’ and look out for the calendar invitation in your inbox.

How are paraplanners feeling about things at the moment? About regulatory change? About day-to day pressures and workload? About emerging technology and its influence on advice? About perception of paraplanning as a profession and career?

Upbeat? Pretty neutral? A bit meh?

Well wonder no more and join us online at 1pm on 25 September 2024 when Craig Spittal of Scottish Widows, will reveal the findings of Scottish Widows’ latest annual survey of paraplanners in the UK.

Craig and host, Richard Allum, will be joined by paraplanners Ceetal Katechia of PSA Financial Services and Sarah Lees of Forvis Mazars to discuss findings that are so fresh off the press, we can only give you a flavour of what we expect to cover during this lunch-hour Assembly. And they are:

- the changing demographics of the UK’s paraplanning population

- the most common misconceptions about paraplanning as a career

- what challenges are adding the most weight to paraplanners’ workloads

- how your paraplanning peers are feeling about role of technology – including AI

- how regulatory change – such as The Consumer Duty – is affecting the day job

- what paraplanners think about potential change in future e.g. an independent pensions policy body

Because it’s an Assembly, we’d love to hear what you’re thinking and feeling about the issues that crop up. So we’ll have lots of polls for you to vote in plus there will be lots of chance to contribute to the conversation in the chat.

For a long time, paraplanners (and paraplanning) were lucky if they received even a passing mention in the conclusions of surveys of advice professionals in the UK. And a dedicated survey only for paraplanners and all about what matters to paraplanning? Unthinkable.

So this online Assembly, packed with findings from original research commissioned and conducted among 200 paraplanners by Scottish Widows, won’t just offer a really clear snapshot of how paraplanners are feeling about the world of advice today. It offers us all a chance to reflect on what’s affecting our profession and help focus our minds on how we’d like to shape our profession in the future.

Want to take part in the conversation? Then book your spot now.

When it comes to gaining and maintaining inheritance tax (IHT) planning know-how and expertise, nothing beats a good case study.

So this special case study investigation, which features not one but two client examples, is bound to be right up your street.

Join Steve and Richard as they crack the case

Because in this 50-minute episode, Utmost International’s Steve Sayer joins host, Richard Allum, to explore why reversionary interest trusts (RITs) combined with the available nil rate band (NRB) threshold, can become a powerful and flexible feature of a client’s IHT strategy.

In a conversation that’s packed with practical insights, ideas and expertise, tax and trusts expert Steve unpacks two case studies which will help you:

– understand the mechanics and key features of a RIT

– consider planning opportunities using RITs especially in conjunction with other options

– be able to discuss and explain RITs and NRB with a client in a clear and concise way

– apply this knowledge to appropriate, individual, client scenarios

Whether you’re a seasoned paraplanner who wants to keep your knowledge fresh or the role of RITs in IHT planning is new territory for you, we’re sure you’ll enjoy the hands-on learning offered by this expert discussion.

Watch or listen now

Just follow the links for a CPD certificate and downloads.

It’s been just over a year since the arrival of The Consumer Duty.

So, whether you’ve been neck-deep in its implementation or still feel like you’re getting to grips with it, now seems like a good time to see how we’re all getting on with it.

That’s why you’re invited to join us online at 1.00pm on Wednesday 14 August 2024 for a lunch-hour Assembly that’s all about The Consumer Duty.

To explore the topic, we’ll be joined by founder of Compliance and Training Solutions (CATS), Mel Holman, and Tom Lloyd-Read, technical planning manager at Stonehage Fleming.

Mel has been providing advice and implementation support to a range of organisations while Tom has been deeply involved in implementation of the Duty within his firm.

Over the course of the lunch-hour Assembly, we’re bound to cover:

- real-life experiences of implementing The Consumer Duty

- practical approaches to demonstrating client understanding

- the ongoing challenge of defining and proving value

- how firms are adapting to support vulnerable clients

- the impact of the retirement income review

What’s more, if our pre-event prep is anything to go by, there’s every chance we’ll touch on cashflow modelling assumptions, dashboards and gap analysis too.

Of course, being an Assembly, not only are you invited to tune into the conversation, we’d love you to share your thoughts and ideas on what’s working, what’s not, and where firms are still figuring things out in the chat.

So if you’re up for an hour’s worth of thoughtful insights and practical takeaways, join the conversion and save your spot now.