When it comes to gaining and maintaining inheritance tax (IHT) planning know-how and expertise, nothing beats a good case study.

So this special case study investigation, which features not one but two client examples, is bound to be right up your street.

Join Steve and Richard as they crack the case

Because in this 50-minute episode, Utmost International’s Steve Sayer joins host, Richard Allum, to explore why reversionary interest trusts (RITs) combined with the available nil rate band (NRB) threshold, can become a powerful and flexible feature of a client’s IHT strategy.

In a conversation that’s packed with practical insights, ideas and expertise, tax and trusts expert Steve unpacks two case studies which will help you:

– understand the mechanics and key features of a RIT

– consider planning opportunities using RITs especially in conjunction with other options

– be able to discuss and explain RITs and NRB with a client in a clear and concise way

– apply this knowledge to appropriate, individual, client scenarios

Whether you’re a seasoned paraplanner who wants to keep your knowledge fresh or the role of RITs in IHT planning is new territory for you, we’re sure you’ll enjoy the hands-on learning offered by this expert discussion.

Watch or listen now

Just follow the links for a CPD certificate and downloads.

It’s been just over a year since the arrival of The Consumer Duty.

So, whether you’ve been neck-deep in its implementation or still feel like you’re getting to grips with it, now seems like a good time to see how we’re all getting on with it.

That’s why you’re invited to join us online at 1.00pm on Wednesday 14 August 2024 for a lunch-hour Assembly that’s all about The Consumer Duty.

To explore the topic, we’ll be joined by founder of Compliance and Training Solutions (CATS), Mel Holman, and Tom Lloyd-Read, technical planning manager at Stonehage Fleming.

Mel has been providing advice and implementation support to a range of organisations while Tom has been deeply involved in implementation of the Duty within his firm.

Over the course of the lunch-hour Assembly, we’re bound to cover:

- real-life experiences of implementing The Consumer Duty

- practical approaches to demonstrating client understanding

- the ongoing challenge of defining and proving value

- how firms are adapting to support vulnerable clients

- the impact of the retirement income review

What’s more, if our pre-event prep is anything to go by, there’s every chance we’ll touch on cashflow modelling assumptions, dashboards and gap analysis too.

Of course, being an Assembly, not only are you invited to tune into the conversation, we’d love you to share your thoughts and ideas on what’s working, what’s not, and where firms are still figuring things out in the chat.

So if you’re up for an hour’s worth of thoughtful insights and practical takeaways, join the conversion and save your spot now.

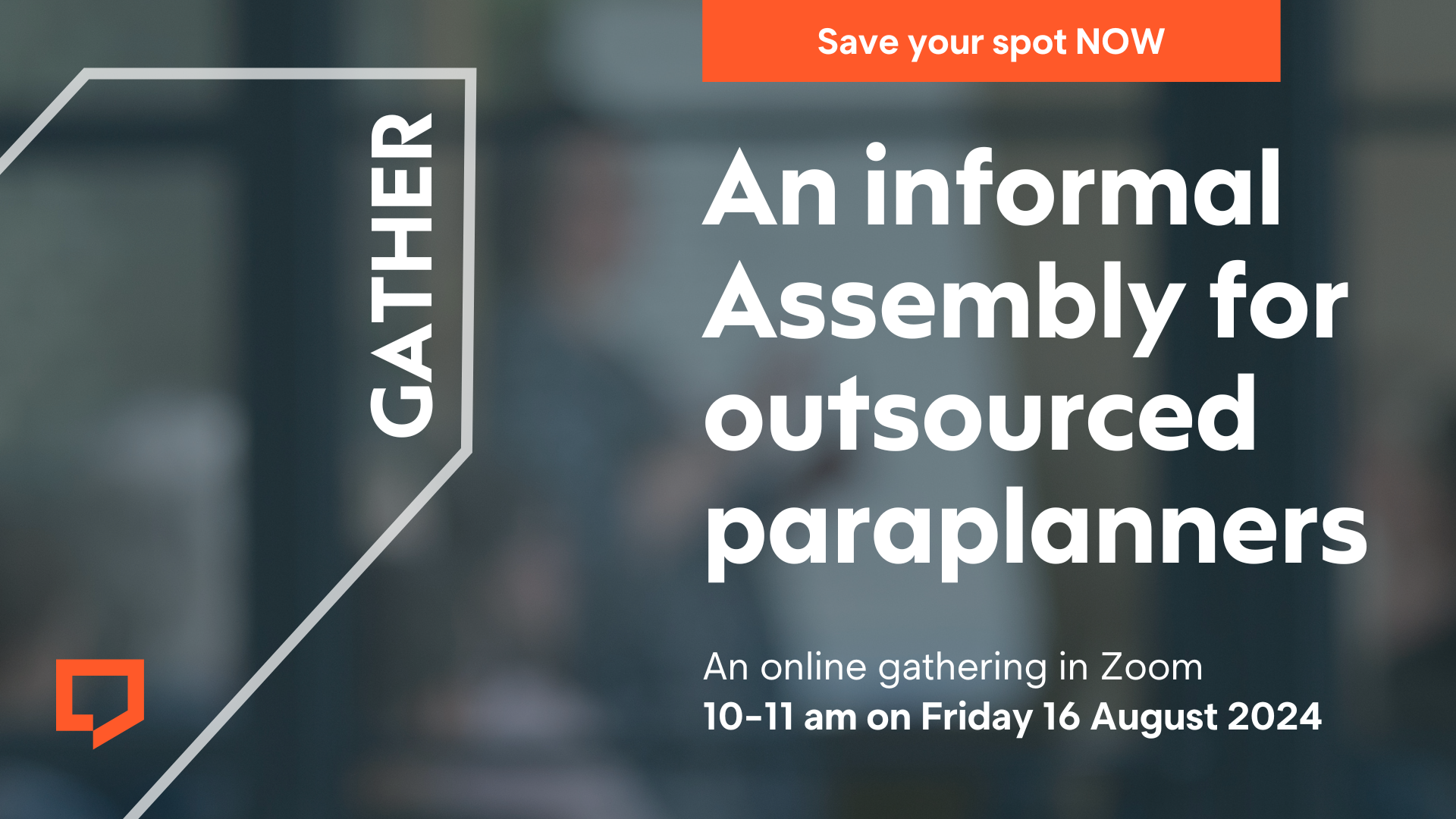

Are you an outsourced paraplanner?

Whether you’re the only employee of your paraplanning practice, or you lead a paraplanning powerhouse with employees and a hefty bank of clients, outsourced paraplanners share lots of things in common.

You just do.

But here’s the thing: despite the growing number of outsourced paraplanners in the UK these days, opportunities to get together to talk only about things that matter in the outsourced world, are surprisingly few and far between.

Switch off. Show up. Join in.

So, if you’re an outsourced paraplanner, here’s our invitation: at 10am on Friday 16 August 2024, set your notifications to ‘do not disturb’, click on the Zoom link in your event invitation and gather with other outsourced paraplanners across the UK for an hour of conversation, ideas and practical insights.

There’s nothing to prepare. Just come along ready to share your answer to one question:

‘What’s on your mind today?’

Spaces are limited. To save a spot hit ‘Book Event’ and look out for the calendar invitation in your inbox.

To mark Independence Day in the United States, we thought we’d treat you to a bonus episode: a bite-sized Assembly that’s all about investing for US expats living in the UK.

Because despite being citizens of the ‘land of the free’, once they leave the USA’s shores, expat savers and investors often face complex challenges to stay on the right side of the US equivalent of HMRC: the Internal Revenue Service (IRS).

So what do paraplanners in the UK need to know to support US expat clients? Who better to ask for expert knowledge and insight than a specialist in investing for US expats: Canaccord Genuity’s Laurence Leigh.

In this bite-sized Assembly, Laurence explores:

- The unique tax challenges facing US citizens abroad – including worldwide taxation and annual IRS returns

- Investment limitations and potential pitfalls, such as the risks of UK ISAs and non-US listed funds

- Solutions for compliant investing – including US-recognised structures and expert portfolio management

In just ten minutes, Laurence covers the dos and don’ts of advising US expats, the limitations of UK platforms, and the severe penalties for non-compliance.

It’s an episode packed with practical advice that will give you confidence in ensuring US expat clients can invest effectively and stay compliant on both sides of the Atlantic.

Working out what to do with your client’s wealth after their death is all part of a paraplanner’s life.

But settling on the best strategy can be complex – especially when missing a vital detail can have costly consequences.

So what can you do about it?

Stay up to date with the latest thinking, that’s what.

Which is why Neil Macleod, senior technical manager at M&G Wealth, joined us to explore death and trusts and paraplanning.

During this lunch-hour Assembly, Neil covered:

- the types of trusts that can be created upon a person’s death

- how to spot different trust structures and what this means

- the income tax and capital gains tax treatment of trustee investments

- strategies for selecting appropriate investments for specific trusts

- practical approaches to providing investment advice to trustees

What will I learn from this online Assembly?

By the end of this Assembly, you’ll be able to:

- identify the types of trusts which can be created on a person’s death

- describe the income tax and CGT treatment of trustee investments

- identify appropriate investments for a particular trust

No matter how complex the cases you deal with, this is a great chance to tune in to Neil’s expertise, and get up to speed on death and trusts.

Brian Radbone, Technical Counsel at Transact, joins Richard to unpack the post-lifetime allowance (LTA) world and its consequences for paraplanners.

In a bite-sized Assembly lasting less than eight minutes, Brian explores transition certificates, new lump sum allowances, and why timing is everything when it comes to crystallising benefits. Plus he discusses the importance of understanding provider restrictions.

If you’re in the market for a post-LTA primer but are pushed for time, this Assembly is ideal.

Are you an outsourced paraplanner?

Whether you’re the only employee of your paraplanning practice, or you lead a paraplanning powerhouse with employees and a hefty bank of clients, outsourced paraplanners share lots of things in common.

You just do.

But here’s the thing: despite the growing number of outsourced paraplanners in the UK these days, opportunities to get together to talk only about things that matter in the outsourced world, are surprisingly few and far between.

Switch off. Show up. Join in.

So, if you’re an outsourced paraplanner, here’s our invitation: at 10am on Friday 5 July 2024, set your notifications to ‘do not disturb’, click on the Zoom link in your event invitation and gather with other outsourced paraplanners across the UK for an hour of conversation, ideas and practical insights.

There’s nothing to prepare. Just come along ready to share your answer to one question:

‘What’s on your mind today?’

Spaces are limited. To save a spot hit ‘Book Event’ and look out for the calendar invitation in your inbox.

Canaccord Genuity’s chief investment officer, Tom Becket, joins Richard Allum for a primer on fixed interest investments that is ideal for paraplanners wherever you are in your career.

During a 20-minute conversation, Tom explains the basics of bonds and gilts, how interest rates affect their values, and how the recent spikes in interest rates have affected returns and revived annuities – putting an end to years of fixed interest investments’ appearing to be ‘uninvestable’.

The likelihood of lower inflation combined with potential interest rate cuts is positive for fixed interest markets.

But Tom is keen to stress that all bonds aren’t created equal and he offers his thoughts on where – depending on the risk appetite of your clients – opportunities might lie across a spectrum of fixed interest investments, from government debt to high-yield credit.

For paraplanners looking to get a handle on this significant but possibly misunderstood asset class, this bite-sized Assembly offers valuable insights to help navigate the fixed interest landscape.

In a special bite-sized Assembly, Transact’s Stuart Fleat explains how model portfolio services offered by discretionary investment managers are able to accessed on platforms like Transact.

In less than six minutes, Stuart explains how platforms and MPS providers are able to handle access to client accounts and data securely and confidentially, how portfolio rebalancing works in practice, practical considerations around capital gains tax, and how clients are invested into the model portfolios.

Once upon a time, we were scouring our library of previous online Assemblies and realised something: we had never covered the topic of inheritance tax (IHT) planning using the alternative investment market (AIM)!

So we thought it was high time to fix that with a whistle-stop tour to discover why investing in AIM is right up there as a strategy for IHT planning.

Whether you’re new to paraplanning and in search of a primer, or you’ve been paraplanning for absolutely ages and want to make sure you really know what you’re talking about, tuning into this Assembly will be well worth your while.

To help us navigate the topic we were joined by the ideal tour guide: Canaccord Genuity’s senior investment director and head of IHT investments, Paul Parker. During our lunch-hour gathering we explored:

- why AIM is so appealing for IHT planning

- business relief and how it works

- why AIM has a reputation for riskier investments

- how clients can invest in AIM – investment managers and DFMs

- researching the suitability of AIM portfolios and their managers

- things to consider when designing an IHT strategy using AIM

As ever, the chat was open for paraplanners to pose questions, or share ideas and observations – and the quality of contributions was great!