It’s been just over a year since the arrival of The Consumer Duty.

So, whether you’ve been neck-deep in its implementation or still feel like you’re getting to grips with it, now seems like a good time to see how we’re all getting on with it.

That’s why you’re invited to join us online at 1.00pm on Wednesday 14 August 2024 for a lunch-hour Assembly that’s all about The Consumer Duty.

To explore the topic, we’ll be joined by founder of Compliance and Training Solutions (CATS), Mel Holman, and Tom Lloyd-Read, technical planning manager at Stonehage Fleming.

Mel has been providing advice and implementation support to a range of organisations while Tom has been deeply involved in implementation of the Duty within his firm.

Over the course of the lunch-hour Assembly, we’re bound to cover:

- real-life experiences of implementing The Consumer Duty

- practical approaches to demonstrating client understanding

- the ongoing challenge of defining and proving value

- how firms are adapting to support vulnerable clients

- the impact of the retirement income review

What’s more, if our pre-event prep is anything to go by, there’s every chance we’ll touch on cashflow modelling assumptions, dashboards and gap analysis too.

Of course, being an Assembly, not only are you invited to tune into the conversation, we’d love you to share your thoughts and ideas on what’s working, what’s not, and where firms are still figuring things out in the chat.

So if you’re up for an hour’s worth of thoughtful insights and practical takeaways, join the conversion and save your spot now.

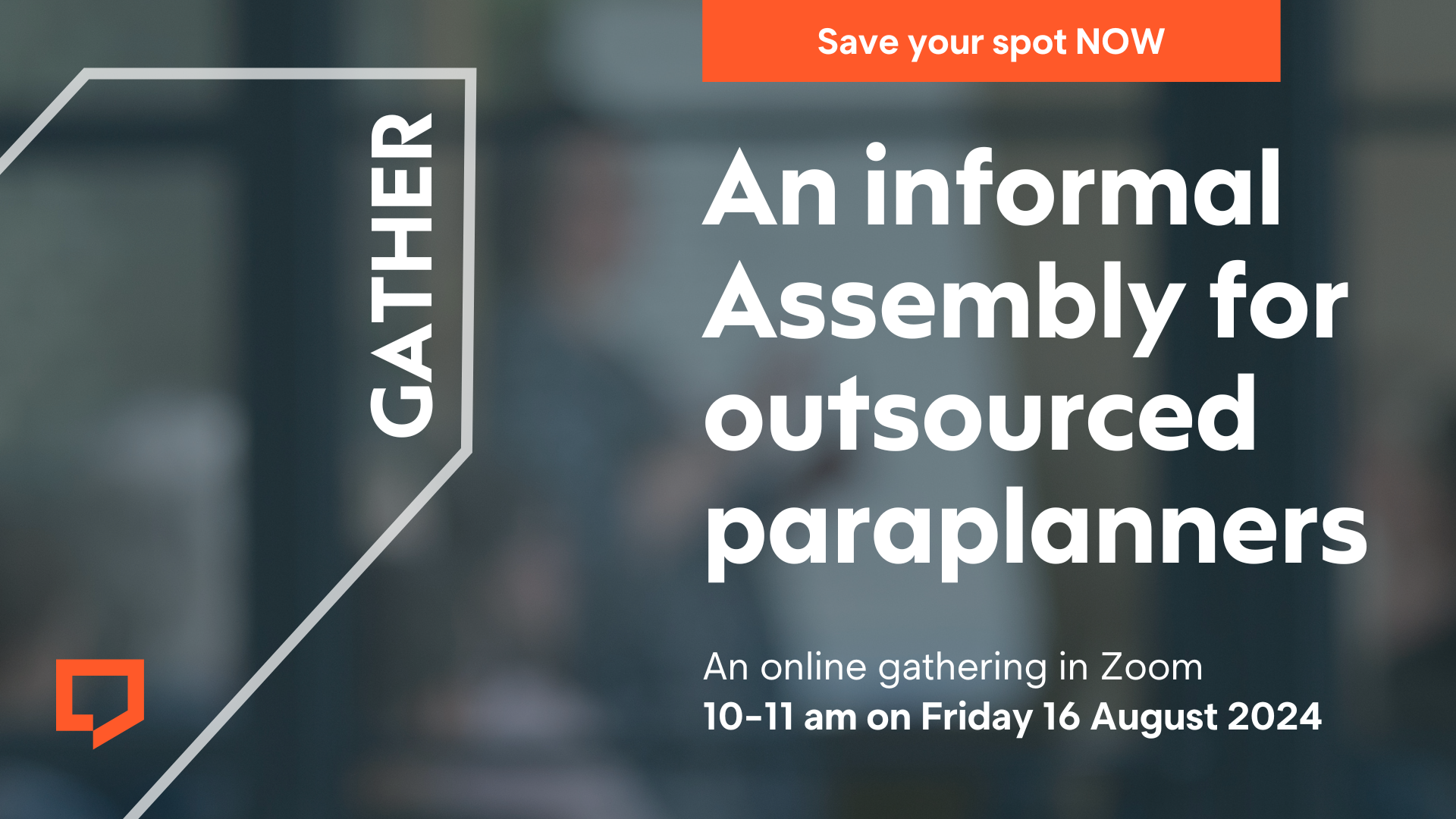

Are you an outsourced paraplanner?

Whether you’re the only employee of your paraplanning practice, or you lead a paraplanning powerhouse with employees and a hefty bank of clients, outsourced paraplanners share lots of things in common.

You just do.

But here’s the thing: despite the growing number of outsourced paraplanners in the UK these days, opportunities to get together to talk only about things that matter in the outsourced world, are surprisingly few and far between.

Switch off. Show up. Join in.

So, if you’re an outsourced paraplanner, here’s our invitation: at 10am on Friday 16 August 2024, set your notifications to ‘do not disturb’, click on the Zoom link in your event invitation and gather with other outsourced paraplanners across the UK for an hour of conversation, ideas and practical insights.

There’s nothing to prepare. Just come along ready to share your answer to one question:

‘What’s on your mind today?’

Spaces are limited. To save a spot hit ‘Book Event’ and look out for the calendar invitation in your inbox.

Working out what to do with your client’s wealth after their death is all part of a paraplanner’s life.

But settling on the best strategy can be complex – especially when missing a vital detail can have costly consequences.

So what can you do about it?

Stay up to date with the latest thinking, that’s what.

Which is why Neil Macleod, senior technical manager at M&G Wealth, joined us to explore death and trusts and paraplanning.

During this lunch-hour Assembly, Neil covered:

- the types of trusts that can be created upon a person’s death

- how to spot different trust structures and what this means

- the income tax and capital gains tax treatment of trustee investments

- strategies for selecting appropriate investments for specific trusts

- practical approaches to providing investment advice to trustees

What will I learn from this online Assembly?

By the end of this Assembly, you’ll be able to:

- identify the types of trusts which can be created on a person’s death

- describe the income tax and CGT treatment of trustee investments

- identify appropriate investments for a particular trust

No matter how complex the cases you deal with, this is a great chance to tune in to Neil’s expertise, and get up to speed on death and trusts.

Are you an outsourced paraplanner?

Whether you’re the only employee of your paraplanning practice, or you lead a paraplanning powerhouse with employees and a hefty bank of clients, outsourced paraplanners share lots of things in common.

You just do.

But here’s the thing: despite the growing number of outsourced paraplanners in the UK these days, opportunities to get together to talk only about things that matter in the outsourced world, are surprisingly few and far between.

Switch off. Show up. Join in.

So, if you’re an outsourced paraplanner, here’s our invitation: at 10am on Friday 5 July 2024, set your notifications to ‘do not disturb’, click on the Zoom link in your event invitation and gather with other outsourced paraplanners across the UK for an hour of conversation, ideas and practical insights.

There’s nothing to prepare. Just come along ready to share your answer to one question:

‘What’s on your mind today?’

Spaces are limited. To save a spot hit ‘Book Event’ and look out for the calendar invitation in your inbox.

Believe it or not, it’s already been nine years since the introduction of pension freedoms. And while it’s fair to say that the arrival of drawdown has transformed the way that clients can plan income in retirement, when the new measures were announced back in 2015, they were made against the backdrop of a generally benign economic climate.

What had changed and what could paraplanners do?

Today, high interest rates and stubborn inflationary pressure, coupled with greater regulatory scrutiny courtesy of The Consumer Duty and the FCA’s retirement income review, make for altogether more changeable weather.

So how are paraplanners expected to make forecasts and hatch plans that will deliver sustainable incomes for clients in their retirement? Plans that stack up under scrutiny – and against the demands – of The Consumer Duty?

During this lunch-hour Assembly, Gareth not only explored these issues but dug into other considerations that could influence paraplanners, advisers and clients when thinking about accumulation and decumulation strategies including:

- Cash flow modelling and stress testing – and its importance

- Is it ‘annuities vs drawdown’ or ‘annuities + drawdown’?

- Platform selection and what to consider

- The abolition of lifetime allowance – what does it mean?

No matter what your experience or expertise as a paraplanner, this 60-minute session offers insights and ideas when considering options for successful and sustainable income in retirement for your clients.

Once upon a time, we were scouring our library of previous online Assemblies and realised something: we had never covered the topic of inheritance tax (IHT) planning using the alternative investment market (AIM)!

So we thought it was high time to fix that with a whistle-stop tour to discover why investing in AIM is right up there as a strategy for IHT planning.

Whether you’re new to paraplanning and in search of a primer, or you’ve been paraplanning for absolutely ages and want to make sure you really know what you’re talking about, tuning into this Assembly will be well worth your while.

To help us navigate the topic we were joined by the ideal tour guide: Canaccord Genuity’s senior investment director and head of IHT investments, Paul Parker. During our lunch-hour gathering we explored:

- why AIM is so appealing for IHT planning

- business relief and how it works

- why AIM has a reputation for riskier investments

- how clients can invest in AIM – investment managers and DFMs

- researching the suitability of AIM portfolios and their managers

- things to consider when designing an IHT strategy using AIM

As ever, the chat was open for paraplanners to pose questions, or share ideas and observations – and the quality of contributions was great!

In a world where even HMRC doesn’t seem too sure what the score is, how can paraplanners get to grips with the new allowances landscape so clients know what they need to know right now?

Well you could tune into this recording of our Assembly with Les Cameron on 24 April 2024 for starters.

Because M&G Wealth’s head of technical took us on a guided tour of the new allowances regime following the abolition of the lifetime allowance (LTA).

What you’ll gain from this Assembly

During this lunch-hour event, hosted by Richard Allum of The Paraplanners, Les explored what has changed, what matters, and what it all means for you and your clients.

In a session that was jam-packed with examples, case studies and practical tips, Les covered all the essentials including

- individual starting allowances

- allowance excesses

- transitional allowances – including transitional tax free amount certificates (TTFACs)

- ongoing allowance availability and use

- death benefits and beneficiaries drawdown

- the importance of the order of benefits

Among the nuggets that Les shared were his analysis of the winners and losers under the new regime, nine things you need to know about TTFACs, and planning opportunities for clients as a result of the changes.

What’s more, he recapped the legislative position as well as shared some good-to-know quirks that the changes are throwing up.

With the post-LTA world still in an apparent state of flux, this is a timely chance to take stock in the company of one of the Assembly’s most popular experts. Want to join in? Then save your spot now.

Back in the days of pandemic restrictions, we would throw open the doors of a Zoom room for an hour on a Friday morning so – whether in-house or outsourced – any paraplanner who was working from home and fancied a natter could drop in (we called them Coffee Mornings).

Despite the return to a more traditional office hours for part of the week, the world of hybrid working and WFH continues to leave loads of us craving a bit of watercooler-style conversation once in a while – if only to stay sane.

Which is why we’re reviving our informal one-hour drop-ins once again.

Pop the kettle on, it’s Elevenses

We’re calling them Elevenses and we’ll be opening the Zoom room for the next one at 11am on Friday 15 March 2024.

To join in, just click the ‘Book event’ button, fill out your details and you’ll receive a calendar invitation with the Zoom link in your inbox (so you don’t forget).

What to expect

There’s nothing to prepare or anything – although a frequent topic of conversation is ‘What’s for tea?’ so be ready for that – so just pour yourself a cuppa, grab a biscuit or two or three or four…and click the link.

Expect to be greeted by a friendly-faced paraplanner or two (Caroline Stuart will definitely be one of the hosts for this gathering).

There might only be two or three of us. And then there might be 20.

You can stay for the whole hour. Or just five minutes. It’s entirely up to you.

See you there?

With the dust settling on the Chancellor’s Budget, Assembly favourite, Les Cameron from M&G Wealth, joined us to cast his expert gaze over the measures announced and what they mean for advice firms and their clients.

Over the course of one lunch-hour, Les explored what Jeremy Hunt’s Budget statement meant for things like inheritance tax, non-dom status, national insurance, lifetime allowance, annual allowance and pretty much any other allowance you can think of.

How many of the Budget measures trailed in the media in advance of the Chancellor’s speech actually materialised or turned out to be Treasury sleight of hand?

As regular Assembly participants know, Les absolutely loves fielding questions on tax and investing (especially from paraplanners) so tune into to see what issues cropped up.

Finally, grab a record of attendance for your CPD visit the dedicated event page for this Assembly at M&G Wealth’s Tech Matters site.

A special tax year end Assembly combining expert insights and Chat-powered Q&A.

Coming just a week after the Budget statement on 6 March, a little over a fortnight before tax year end, and while the Finance Bill from last October’s statement is still making its way through Parliament, it was the ideal time to tune in to what you really need to know as the tax year hits its paraplanning peak.

To help, we gathered together a stellar panel of experts to share their knowledge and know-how: Les Cameron from M&G Wealth, James Jones-Tinsley of Barnett Waddingham and Transact’s Brian Radbone. (Scottish Widows’s Tom Coughlan, was due to join us but technical gremlins proved too much of an obstacle.)

Expect a lunch-hour discussion laden with lashings of insights on allowances, reliefs and exemptions spanning pensions, ISAs, capital gains tax and inheritance tax (and everything in between).