The tax landscape has shifted significantly over the past couple of years. Allowance reductions, rising dividend tax rates and the proposed extension of IHT to unused pensions means there’s plenty for paraplanners to get to grips with — and plenty of opportunity to add real value for clients.

This Assembly is designed to cut through the complexity and give you a clearer picture of how different tax wrappers work in practice, so you can make more confident decisions about which solution is right for which client.

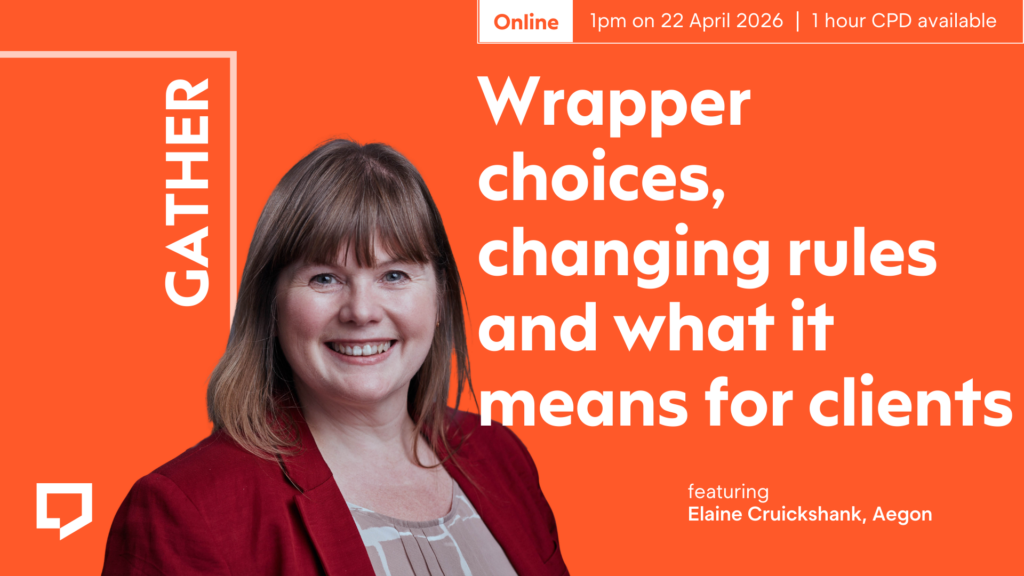

We’ve invited Elaine Cruickshank, tax and trusts manager at Aegon, to join host Richard Allum for a practical, no-nonsense look at onshore bonds, offshore bonds, GIAs and trust solutions — with an agnostic perspective that keeps the focus firmly on what’s best for the client in front of you.

What we’ll be exploring

We’ll look at how recent tax changes are prompting advisers and paraplanners to revisit wrapper choice, and walk through the kind of comparative thinking that helps you work out when a bond might be preferable to a GIA — or when onshore makes more sense than offshore.

We’ll also take a look at how onshore bonds are actually taxed (including a common misconception that’s worth clearing up), which wrapper tends to suit which client circumstances, and how trust solutions fit into the picture — particularly in the context of the proposed IHT changes to pensions.

What can you expect to take away?

You’ll leave with a clearer understanding of the tax treatment of different wrappers, a more confident sense of when each option is likely to work best, and some practical frameworks for thinking about trust planning solutions. We’ll share the comparative calculations in the slides afterwards, so you can refer back to them whenever you need to.

Whether you’re looking to sharpen your technical knowledge or just want to feel more confident having these conversations, join us online at 1.00 pm on Tuesday 22 April.

Pensions will become subject to inheritance tax (IHT) from April 2027, but how much of a role does protection play in your approach to building IHT strategies for your clients? And how confident are you about the protection options that are available to you?

But with IHT receipts expected to almost double, and sweeping changes to business and agricultural property relief already landing from April 2026, paraplanners can expect more and more clients to want to explore all the options.

So at this Assembly, host Richard Allum was joined by Alan Jenkinson, protection specialist at Scottish Widows, to walk through the essentials. During their lunch-hour discussion, Richard and Alan unpack IHT and how it works, run through the key exemptions and reliefs, and explore how protection fits into an IHT planning conversation alongside gifting strategies, trust structures and the normal expenditure out of income rules.

There’s also a really useful section on the underwriting process: what to do when a client has health risk factors, when concurrent applications make sense, and why a declined application isn’t necessarily the end of the road.

If you’re looking for a solid grounding in this area — or a practical refresher before your next client review — this one’s well worth an hour of your time.

Budget measures are often the subject of media speculation. But the level of attention in the run-up to the Chancellor of the Exchequer’s Budget statement on 26 November 2025 was unprecedented.

So did the reality match the hype?

For our final Assembly of 2025, we invited Les Cameron from M&G Wealth to join us and share his latest thoughts on what paraplanners need to know following Rachel Reeves’s statement.

Les covers a bunch of different topics that include:

- Inheritance tax changes and business relief updates

- Capital gains tax rates and allowances

- ISA allowances

- Pensions, IHT liability and the role of personal representatives

- Salary sacrifice

- Tax rates, bands and allowances

- Beneficial ordering

- The effect of fiscal drag (or ‘stealth taxes’)

Plus more besides. So if you want to catch up with what’s been announced, what’s changing, or what’s staying the same, this is the Assembly for you.

Assemblies featuring the M&G technical team in 2025

This is the fifth Assembly of the year featuring experts from M&G Wealth’s technical team. Here are the other four from 2025:

February 2025 – Pensions, death and taxes (with Les)

April 2025 – A guide to investment bond essentials for paraplanners (with Barrie Dawson)

August 2025 – Tax wrappers: which, why and when? (with Neil Macleod)

September 2025 – The pension IHT bombshell has landed – now what? (with Les)

When a client dies, their will isn’t necessarily the final word on how their estate gets distributed. Deeds of variation and disclaimers give beneficiaries a valuable window – two years from death – to reshape inheritances in ways that can reduce tax bills and improve family outcomes – often both.

In the latest episode in our ‘Technically speaking’ series, we invited Steve Sayer from Utmost to join host Richard Allum, to cast his expert gaze on the post-death planning issues that paraplanners need to consider.

During the hour-long session, Steve explains:

- how deeds of variation work;

- the conditions needed for them to be effective for IHT and CGT purposes;

- practical situations where they make sense;

- related settlements;

- ‘reading back’ provisions; and

- CGT planning opportunities that variations can create.

What’s more, the session also explores disclaimers – the simpler but more restrictive alternative to variations. Steve clarifies:

- the ‘all or nothing’ rule;

- when disclaimers work best; and

- how they differ from deeds of variation in practice.

Throughout the episode, Steve offers examples to help illustrate concepts such as periodic charges and ten-year anniversaries.

If you’re working on suitability reports that cover post-death planning options, are supporting a client following a death, or would just like to give your technical knowledge a boost, this is the ideal ‘Technically speaking’ episode for you.

If you want to know what’s on the minds of other paraplanners, then this is definitely the Assembly for you.

That’s because Scottish Widows’s Craig Spittal joined host, Richard Allum, and guests Alison Neale of Principle Paraplanning, to exclusively reveal key findings of this year’s Scottish Widows‘ Paraplanner Survey ahead of it’s formal publication in November 2025.

Since recording the results have been published and you’ll find them here.

Original insights on the big issues

During this recording of a lunch-hour online Assembly, Craig shares findings from a sample of 200 paraplanners who completed the third annual survey of paraplanners. Topics covered include:

- Job satisfaction – Do your paraplanning peers feel supported in their current role? And how eager are they to gain greater recognition and influence, and clarity over possible career paths? How high is confidence in the profession overall – and is it the same for everyone at every age?

- Platforms and due diligence – How many platforms do paraplanners use day to day? And what are the issues that grind paraplanners gears? Tune in to hear Alison, Craig and Richard’s thoughts.

- AI and tech – Is the desire for automation matched by tech adoption in paraplanners firms? Or are things moving far slower than the hype suggests? What – if anything – is holding paraplanners back from AI adoption? And how convinced is the community by the promise of AI? Does the carrot of greater efficiency dilute concerns about accuracy and data security?

What can you expect to take away?

Listen and you’ll hear practical insights, honest reflections, and a clear idea of where paraplanners like you think our profession is heading.

So tuck in to a helping of hot-of-the-press original research and take this chance to reflect on the attitudes and trends that are influencing paraplanning today.

Here’s a question that might hit close to home: when you’re crafting retirement recommendations, are you addressing the three big risks that keep clients awake at night — or are you unknowingly leaving them exposed to sequence of returns risk, longevity risk, and inflation erosion?

As paraplanners, we have the power to transform retirement outcomes by understanding how product innovations can take these critical risks off the table. But are we truly using the full toolkit available to us? Or are we sticking with conventional approaches that might not deliver the stable, reliable income our clients need?

It matters because retirement planning has evolved beyond traditional drawdown strategies. The FCA expects us to distinguish between accumulation and decumulation approaches, and innovative product solutions now exist that can protect clients from running out of money — even if they live to 100.

Expand your knowledge in one hour

This Assembly – originally recorded on 1pm on 15 October 2025 – was the second part of our exploration into the retirement risk zone, focusing specifically on how product innovations can deliver better outcomes for your clients. You’ll find part one here.

In this online Assembly Connor Stewart from Standard Life joined host, Richard Allum, to explore this facet of the retirement risk zone.

Together, they explore what clients truly want from retirement (and what terrifies them), how regulatory expectations are driving change, and most importantly, how you can use cutting-edge product solutions to deliver the security and growth your clients need.

During this Assembly we:

- revisit what clients want from retirement and what keeps them awake at night

- understand how FCA guidance shapes our approach to retirement risk zone planning

- explore how sequence of returns risk, longevity risk, and inflation can be effectively managed

- examine innovative product solutions including smooth funds and guaranteed lifetime income

- work through real case studies that bring these concepts to life

- discover practical strategies for incorporating these innovations into your recommendations

What can you expect to take away?

You’ll leave this Assembly with actionable insights into product innovations that can transform your retirement planning approach. You’ll understand how to match these solutions to specific client needs and circumstances, ensuring you can deliver genuinely tailored retirement strategies.

Most of all, this session will equip you with practical tools and case study examples so you can confidently recommend product innovations that protect clients from the major retirement risks while helping them achieve their long-term goals.

Here’s a question that might keep you awake at night: what do you tell clients who’ve spent years building pension pots specifically because they were IHT-free, only to discover that’s all changed?

On 21 July 2025, HMRC published their response to the pension IHT consultation, along with draft legislation that will bring unused pension pots into the inheritance tax net from April 2027. The writing’s been on the wall since Rachel Reeves’ October 2024 Budget announcement, but now we have the detail and it’s time to work out what this means for our clients.

As paraplanners, we’re about to face some of the most fundamental shifts in retirement and estate planning strategy we’ve seen in years. The days of treating pensions as the IHT-free golden goose are numbered, and clients will be looking to us for answers.

This isn’t just about understanding the new rules. It’s about completely rethinking how we approach pension planning, estate planning, and the delicate balance between the two.

Your crash course in the new pension IHT landscape

In what turned out to be an essential Assembly, we were joined by M&G’s Les Cameron to dive deep into the practical implications of these seismic changes. We strongly recommend reading M&G’s detailed response before watching the Assemly as it provides crucial context for our discussion.

During this Assembly, we evaluated the different options to mitigate pension-driven IHT liabilities, including:

- Are pensions dead? – separating the headlines from the reality for long-term retirement planning

- Is whole of life the answer? – when life assurance might fill the IHT gap

- Moving client money – the practical considerations of reshuffling portfolios

- Annuities vs drawdown – how the IHT changes affect this fundamental choice

- Bypass trusts – exploring whether trust structures can still provide solutions

What can you expect to take away?

You’ll leave this Assembly with a clear understanding of how the new IHT rules will work in practice and with strategies you can implement immediately to help clients navigate this changing landscape. We hope to give you the confidence to tackle those difficult conversations about restructuring retirement plans that took years to build.

Fair warning: there’s so much ground to cover that we may run slightly over our usual 60 minutes. If we do, we’ll schedule a follow-up session to tackle any outstanding questions.

Once upon a time, when taxes were relatively low, ISAs and unwrapped investments seemed like pretty obvious choices for clients’ money.

But the big cut in the capital gains tax allowance and rises in tax on gains and dividends has changed things. Tax wrappers that once seemed like more hassle than they were worth (like investment bonds) could now be the ideal vehicle – especially for higher rate taxpayers.

But which wrapper is right in which circumstances and why?

That’s the question that guest Neil Macleod from M&G’s technical team was invited to answer when he joined host, Leanne Pickering, for this Assembly.

What you’ll learn by listening

Over the course of one lunch hour, Leanne and Neil explored when bonds are more suitable, when offshore makes sense, and why the ‘best’ mathematical answer might not actually be the right choice for your client. In this Assembly you’ll:

- learn from real case studies that compare basic rate versus higher rate taxpayers

- find out how to use withdrawals strategically to fund ISAs

- discover why different asset types work better in different wrappers

- tackle those tricky questions about investing within trusts

- understand why paying a bit more tax sometimes makes perfect sense

You’ll discover that the right choice for your clients isn’t just about what the spreadsheet says but about the broader thinking

What’s more, once you’ve listened, follow the link below and you can request a record of 1 hour’s worth CPD too.

With recent changes to capital gains tax rates reaching up to 24% and the CGT annual exemption frozen at just £3,000, many clients are looking for tax-efficient ways to structure their investments.

In his latest ‘Technically speaking’ session for the Paraplanners’ Assembly, Utmost’s Steve Sayer explores how offshore bonds and trust structures work together – offering inheritance tax planning options that provide flexibility for clients who want to be prepared for the ‘what ifs’ of life.

Packed with helpful examples and case studies

Steve brings the options to life with a series of examples of different trust arrangements and how they can be combined.

He’ll show you how discounted gift trusts can provide an immediate reduction in estate value, how loan trusts offer capital access, and why reversionary interest trusts might help hesitant clients take their first steps with inheritance tax planning.

The session includes a detailed case study showing how married clients in their sixties, with £3.5 million in assets, could use multiple trust structures to meet their annual income needs all while reducing their inheritance tax liability.

What’s more, you’ll learn about the planning opportunities that come with non-UK long term residence status and how offshore bonds can keep assets outside the UK inheritance tax net.

And to round off his session, Steve shares a decision-tree approach that you’re bound to find useful when you’re weighing up client needs.

What are the learning outcomes?

Once you’ve watched or listened to this episode, you will:

- Understand some concepts of UK IHT planning including:

- Inheritance planning opportunities using discounted gift, reversionary interest and loan trusts.

- How trusts can be used to provide access to capital and/withdrawals for lifestyle planning.

- Discuss and explain this subject with a client in a clear and concise way.

- Apply this knowledge to appropriate, individual, client scenarios.

Once you’ve watched or listened, make sure you grab your CPD

CPD: Take the quiz to receive your certificate

Paraplanners from all over the country gathered on Thursday 9 October 2025 at FarmED in rolling Cotswold countryside – the last time the Big Day Out was being at the venue.

An introduction to AI for Paraplanners

Participants were welcomed by The Big Day Out hosts, Aleks Sasin and Chris Wormwell, before Harriet Meyer kicked the day off with An introduction to AI for paraplanners.

What were the big takeaway messages from the session?

Used properly, large language models (LLMs) like ChatGPT, Claude, Copilot and Gemini can be powerful tools to aid the writing process that sits at the heart of your role. From client communications to suitability reports, the quality of your written work directly impacts client outcomes and regulatory compliance.

In this highly interactive session, award-winning financial journalist and AI trainer Harriet, cut through the AI hype using hands-on exercises where participants could practice effective prompt design and see real examples of how AI can improve client communications, streamline report writing, and support documentation tasks.

Whether you had never used AI tools, experimented with basic applications, or were already incorporating AI into your workflow but want to improve your technique, Harriet’s session offered lots of opportunities to learn together with paraplanning peers.

Technical pick-and-mix sessions

Ahead of the Big Day Out, participants were invited to pick two hour-long technical and financial planning client scenario sessions (from a choice of four). The topics were:

IHT Planning: Foundation

This session focused on helping participants strengthen foundational understanding of inheritance tax planning, and offer a structured refresher on core principles.

Through an interactive scenario-based discussion, they worked through client situations and explored different approaches, understanding the practical application of IHT planning principles and the trade-offs involved in different strategies. We explored the essential framework of “spend it, gift it, or insure it” and how these principles apply in practice. Issues covered included residence nil rate bands, tapering rules, and gifting allowances, alongside practical solutions like life cover. Participants also touched on the importance of Wills and Powers of Attorney, and even some discussion of deed variations.

IHT Planning: Advanced

This session tackled more complex planning scenarios involving multiple strategies and significant assets. Participants considered the complexities of advanced planning strategies, examining real-world trade-offs and the practical challenges of implementing sophisticated solutions, including the order of gifting, trust planning, and business relief considerations. With pensions now in the IHT net from 2027, the session explored how pension planning intersects with inheritance tax strategy. The session also examined when and how to use different planning tools, and the consequences of getting the sequencing wrong.

Retirement Income Planning: Foundation

If you wanted to strengthen your understanding of retirement income options and, particularly, building confidence around annuity recommendations, this was the session for you. Participants gained a comprehensive grounding in the core retirement income options available to clients with the session covering the fundamentals of drawdown versus annuities, tax-free cash decisions, securing essential income, and how State Pension fits into the picture.

Retirement Income Planning: Advanced

If you are comfortable with retirement income products but wanted to enhance your skills in creating comprehensive, client-focused retirement strategies that meet FCA expectations, then this was the session for you.

Participants explored sophisticated techniques for capturing client requirements, categorising needs into essential, desired, and legacy funds, and creating robust cash flow models. Groups discussed tax wrapper strategies, sequencing risk, and how to build retirement plans that will withstand regulatory scrutiny while truly serving client needs.

Your career, your choice: Designing your professional future

Paraplanner Zara Okoro invited participants to explore what really drives you professionally, where your strengths lie, and how to turn sector changes into career opportunities. Using a framework, Zara asked the Assembly to break out into groups of four and work through a series of questions which participants could use as lenese to explore where they are in their career today, and what they want to do next.

Whether you were early in your career or well-established, this session worked for anyone ready to take ownership of their professional development.

The ideal session for heading home knowing where to focus your efforts and how your future career growth could benefit both you and your employer.

The Assembly

Led by Big Day Out hosts Aleks Sasin and Chris Wormwell, and observing the Chatham House Rule, this open session handed the floor over to participants. Whether you wanted to dig deeper into topics covered earlier, raise something completely new, or simply pick the brains of the experts and fellow paraplanners in the room – it was entirely up to participants.

paraplanners and we also welcome administrators, so if you are not one please don’t book a ticket. If you’re still really interested in coming along then get in touch with us at [email protected].